Our proprietary Stock Power Ratings boils down almost any company you can think of to a simple score. What does it say about Graco stock (NYSE: GGG)?

Graco Inc. is a company that has been around since 1926.

It is a leading manufacturer of equipment and systems for industrial, commercial and consumer markets.

The company has seen steady growth over the past few years and is continuing to look toward the future with optimism.

In this article, we’ll take a brief look at Graco’s business and its outlook for 2023. Then, we’ll run Graco stock through Stock Power Ratings to see how it stacks up.

Graco’s History and Outlook

Graco, founded in 1926, is headquartered in Minneapolis, Minnesota.

The company manufactures equipment and systems for industrial, commercial and consumer markets worldwide.

Its products are used by professionals in the automotive, aerospace, electronics, food processing, medical device manufacturing, packaging and the printing and graphics industries.

Over the past few years, Graco has seen steady growth as it continues to expand its market share across multiple industries.

Graco’s outlook for 2023 is optimistic as the company looks to build on its success in recent years.

With a focus on innovation and customer service, Graco hopes to remain competitive in an ever-evolving marketplace while continuing to provide quality products at competitive prices to their customers.

To reach these goals Graco has increased its research and development budget significantly. That should help ensure that it stays ahead of its competitors when it comes to product innovation and technological advancements.

The company also plans to continue its expansion into new global markets while maintaining its strong presence in existing ones.

By leveraging its expertise in international trade agreements it can reduce taxes and tariffs which allows it to stay ahead of the competition when it comes to pricing structure for their products.

Additionally, by focusing on developing countries within the Asia Pacific region, Graco hopes to expand its customer base even further over the next few years. That should lead to continued sustainable growth for Graco well into 2023 and beyond.

Let’s see if that’s reflected in its ratings.

Graco Stock Power Ratings

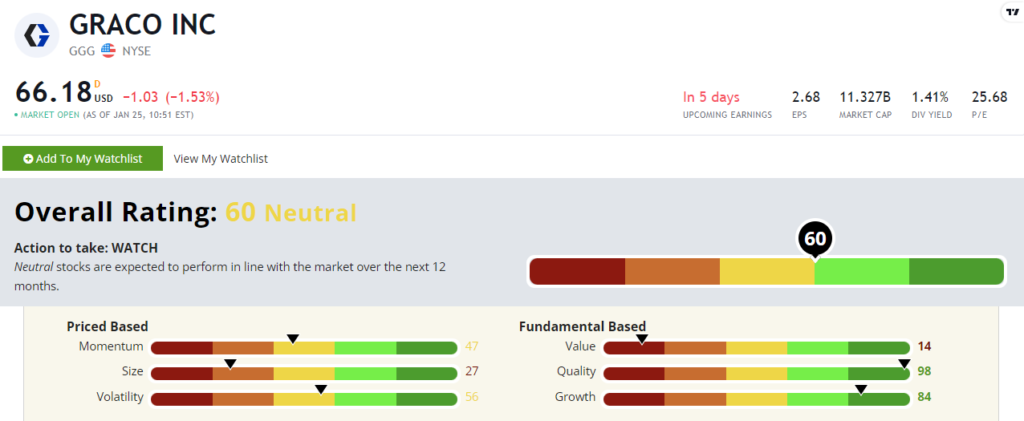

Graco stock rates a “Neutral” 60 out of 100. That means our system expects the stock to perform in line with the broader market over the next 12 months!

Graco is strong on our quality factor. Here are some of the highlights from its most-recent quarterly report:

- Return on assets of 18.8%.

- Return on equity of 27.12%.

- And return on invested capital of 25.05%.

Those are just some of the subfactors that contribute to Graco stock’s excellent 98 out of 100 quality score.

It’s also sports fantastic growth at an 84 factor score. It reported 12.11% total revenue growth in Q3 2022 over the previous quarter. Gross profits also grew 5.18%.

Finally, I want to look at GGG’s momentum, which comes in at 47. Over the last year, Graco stock lost almost 6% of its value, which is right in line with the broader S&P 500.

Bottom Line: Graco is doing a lot to make 2023 a successful year for investors.

But if you follow Stock Power Ratings, Graco stock is just one to watch for now.