Exchange-traded funds can provide investors with immediate diversity to their portfolio and, according to Warren Buffett, the best retirement plan invests 90% of your funds in the S&P 500 — but what is the best S&P 500 ETF to buy?

Money and Markets compiled a list of the best funds that track the benchmark that roughly corresponds to the American economy, ensuring that your money is well invested. (Pro tip: Buffett’s Berkshire Hathaway actually bought into two of these ETFs in Q4 2019).

Best S&P 500 ETFs to Buy

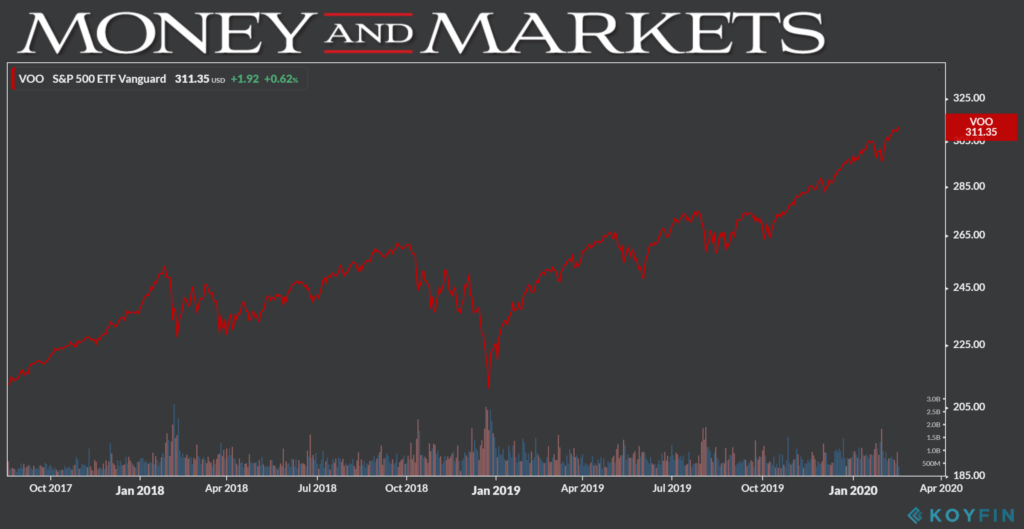

1. Vanguard S&P 500 ETF (VOO)

Issuer: Vanguard Group.

Market Cap: $145 billion.

Assets Under Management: $145 trillion.

Expense Ratio: 0.04%.

The Vanguard S&P 500 ETF (NYSEARCA: VOO) is the most recent of our best S&P 500 ETFs to buy to come to market after launching in September 2010.

This ETF comes with a very small expense ratio of 0.04% and exposes an investor to the top 500 companies in the U.S. So, you get diversity in your investment as well as a little more safety because all of the companies are here.

Just like others on our list, its performance closely tracks the S&P 500, but what makes Vanguard’s offering perhaps the best, in addition to its low expense rate, is its lower cost.

It’s priced at just above $310 per share — the lowest price on our list.

VOO discloses its holdings monthly rather than daily and it reinvests its interim cash. Over the last five years, VOO has returned about than 12% to its investors on average. It also recently paid a $1.42 dividend per share.

A low expense rate and cheaper price point make the Vanguard S&P 500 ETF one of the best S&P 500 ETFs to buy.

2. iShares Core S&P 500 ETF (IVV)

Issuer: BlackRock iShares.

Market Cap: $219 billion.

Assets Under Management: $219 trillion.

Expense Ratio: 0.04%.

The iShares Core S&P 500 ETF (NYSEARCA: IVV) is not as well-known as the other ETFs on the list, but its performance is rock solid.

Like VOO, BlackRock’s offering returned about 12% to investors in the last five years. The fund comes with a 0.04% management fee but did recently pay investors a dividend of $2.03 per share.

Among its top holdings are Microsoft Corp. (Nasdaq: MSFT), Apple Inc. (Nasdaq: AAPL) and Amazon.com Inc. (Nasdaq: AMZN). Plus, investors can have confidence as BlackRock is one of the largest asset management firms in the world. Additionally, iShares is one of the largest ETF providers.

As with the other ETFs on the list, IVV’s performance is right in line with the S&P 500, which has grown more than 47% since December 2018.

IVV’s liquidity is also solid as it trades nearly 850 million shares every day. It also isn’t a unit investment trust, so cash drag isn’t a problem either.

With a strong dividend and low management fee, the iShares Core S&P 500 ETF is one of our top S&P 500 ETFs to buy.

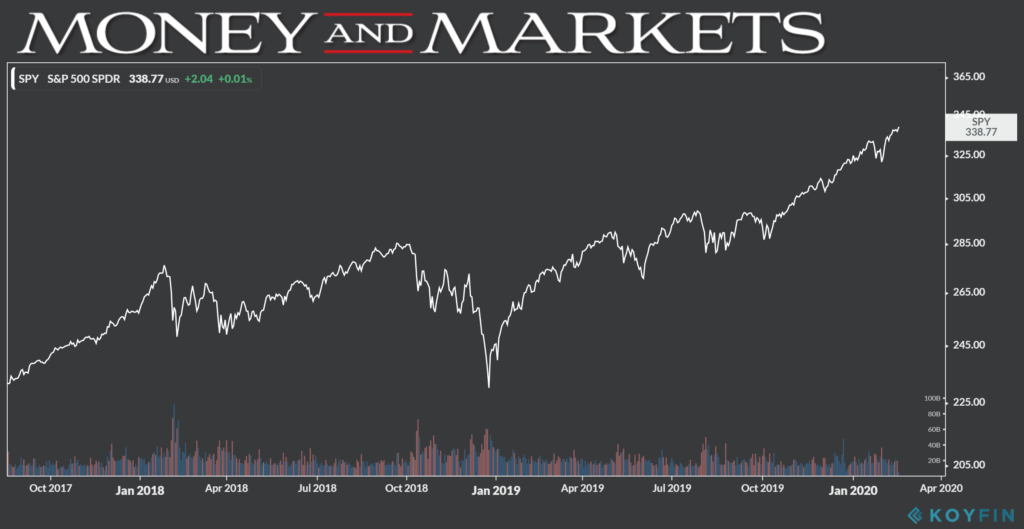

3. SPDR S&P 500 ETF

Issuer: State Street Global Advisors

Market Cap: $322 billion

Assets Under Management: $322 trillion

Expense Ratio: 0.09%

The largest and perhaps most well-known ETF on our list is the SPDR S&P 500 ETF (NYSEARCA: SPY).

It has more than $322 trillion in assets under its management and is also the oldest of the S&P 500 benchmark funds.

However, SPY is a unit investment trust, not a traditional ETF. That means it offers a fixed portfolio as redeemable units to investors for a specific period of time.

This ETF is geared more to provide capital appreciation and dividend income.

SPY prides itself on liquidity as it trades nearly 16 billion shares every day. It’s a rock solid choice if you are looking for a buy-and-hold investment in addition to a traditional 401(k).

Its benchmark returns are higher than the other two ETFs on the list. Over the last five years, SPY has returned 13.8%. It’s most recent dividend was $1.57 per share.

One thing to keep in mind is that SPY does have a higher expense ratio than the others, but the difference is quite small.

Because of its liquidity and solid gains, the SPDR S&P 500 is one of our top S&P 500 ETFs to buy.

If you are looking for diversification, solid performance and low fees, these three ETFs certainly fit the bill.

But remember, there are no guarantees in life. Like with individual shares, these ETFs can move up and down in price at a moment’s notice.

That said, if you are looking for a solid place to invest your hard-earned money that tracks the most widely watched benchmark — and comes highly recommended by the Oracle of Omaha — you can’t go wrong with any of our best S&P 500 ETFs to buy.

Related:

- 3 Cheap 5G Stocks to Buy Right Now

- 6 5G Dividend Stocks to Buy Now

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- 5 5G ETFs to Buy Now

Looking for more stocks to buy now? Let us know by emailing us at feedback@dev.moneyandmarkets.com or drop a comment below.