In this week’s Investing With Charles, research analyst Matt Clark and I discuss two retail giants: Walmart Inc. (NYSE: WMT) and Amazon.com Inc. (Nasdaq: AMZN).

We hit on Walmart yesterday. Check it out here.

Both stocks are strong.

But one is more robust, and I’d consider it the better buy this holiday season.

We hit on Walmart yesterday, so let’s see how Amazon stacks up.

Amazon Is More Than Retail

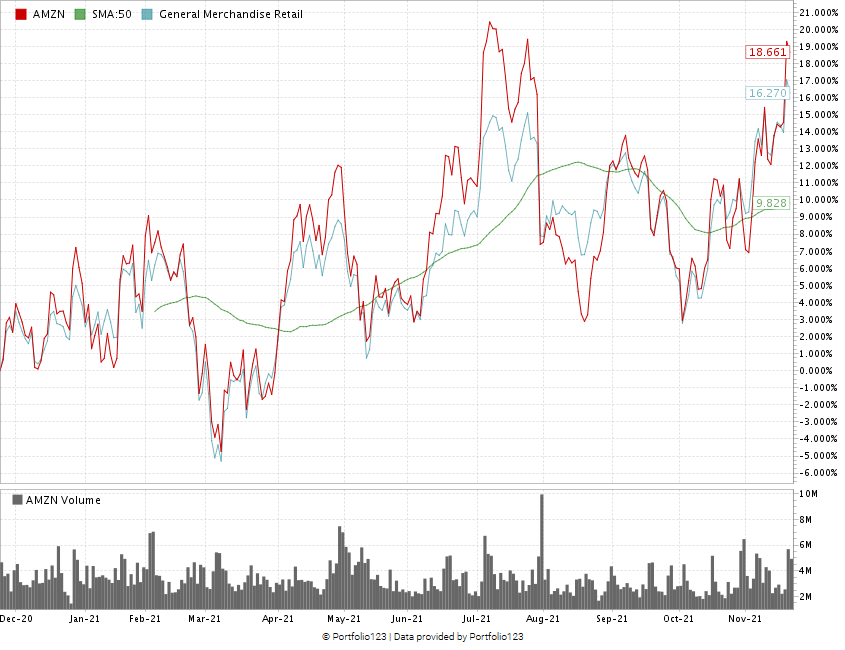

Matt: Amazon is actually beating its peers, and it’s beating general merchandise retail. It’s up almost 19% over the last 12 months, and it’s trading double its 50-day simple moving average.

AMZN Beats Its Peers

So, why is Amazon up here after it had a pretty decent 2020?

Charles: If there was any company in the world that could compete with Amazon, it would be Walmart. But Amazon is still the king here.

Remember, Amazon is not just retail. The boxes that show up at our doorstep are its retail business, but Amazon is also the leader in cloud computing by a pretty wide margin.

There are other players in the game like Microsoft, Google and IBM … but Amazon leads the charge there.

It is also becoming a logistics company. Walmart is a logistics company as well, but Amazon is building out a global fleet here.

It’s a different kind of company, more than retail. And that shows up in its valuation. Amazon’s price of sales ratio is over four, which makes its valuation similar to a tech stock like Microsoft or Google. That’s the difference here. Amazon is not simply a retailer: It’s a retailer and a tech stock.

Matt: Amazon leans on its Amazon Web Services (AWS) platform to generate a ton of sales. It bolstered the stock during 2020.

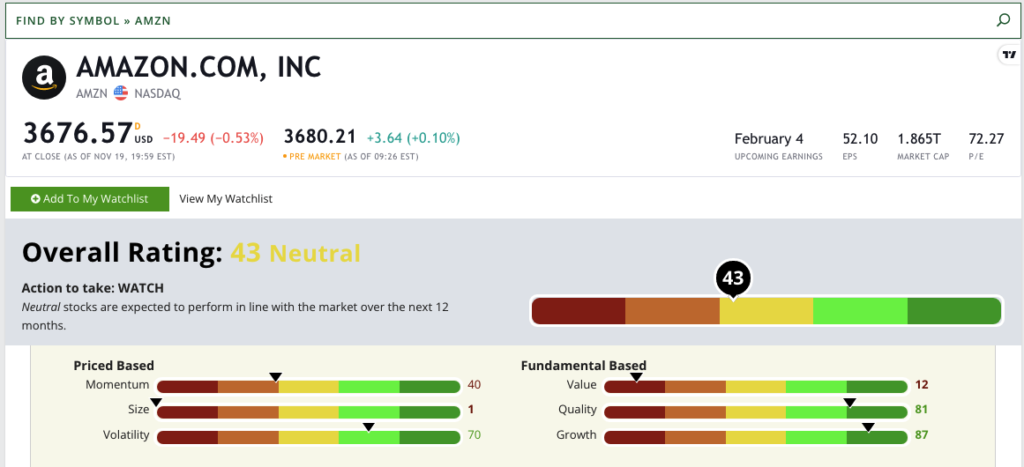

AMZN’s Green Zone Rating

Amazon, at 43, actually rates lower than Walmart in our Green Zone Ratings system.

Amazon.com Inc.’s Green Zone Rating on November 22, 2021.

Obviously, Amazon gets dinged on size with its $2 trillion market cap. Its momentum also rates low.

Amazon ranks in the green in quality and growth, which is a common theme among tech stocks. It also ranks in the green on volatility, despite the fact that we have seen some ups and downs in its stock price.

Charles: Amazon really gets zinged on value at 12. It loses its shirt there. The good thing is, if it loses its shirt, it can just same-day deliver a new shirt using its own platform!

Amazon is, by no stretch of the imagination, an inexpensive stock. Its share price is hovering around $3,500 right now. But you’re buying the growth, the dominance and the world-beating market position here. It’s very rare to find a company of this quality that doesn’t trade at a premium. So the low score you see on value here is to be expected.

Walmart vs. Amazon: The Better Stock to Buy?

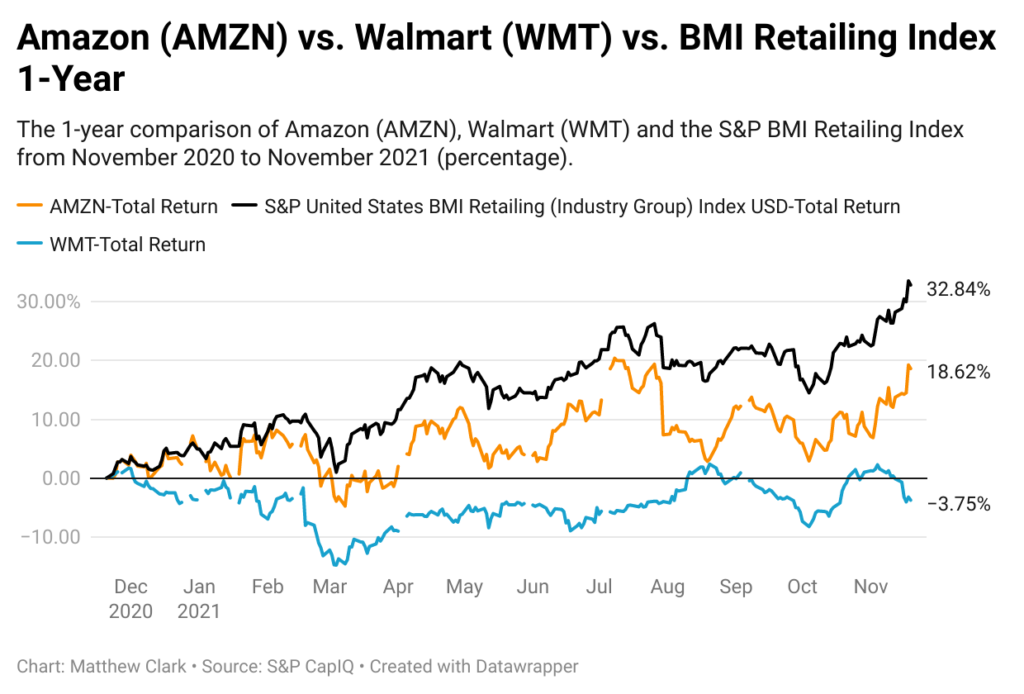

Matt: To compare apples to apples here … the retailing index is up almost 26% year-to-date, and AMZN is up 12.8% in that same time frame.

If you take all three — AMZN, WMT and BMI — and put them together in one chart, you see that Walmart is down about 4% — whereas Amazon is up almost 19%. The BMI retailing index is up almost 33%.

Walmart was an essential business and stayed open during the pandemic. It has essential supplies, and it really made its bones that way.

Amazon was able to capitalize on the online buying trend but also leaned into its AWS platform and its logistical underpinnings. Amazon has continued to move upward, and it’s still showing a positive trend.

From 2018 to 2021, Amazon started at a multiple price-to-earnings ratio — close to 200. And since then we have seen a decline. It’s around 64 now.

Walmart, on the other hand, has been relatively flat and has started to tick upwards as its stock price has gone down. As of today, you’ve got a P/E ratio for Walmart of about 52.

The P/E gap has narrowed significantly. That tells me these companies are getting much, much closer in terms of valuation for their stock prices.

Charles: It used to be that Amazon was expensive relative to everything. And that is not the case today. It is an expensive stock, for sure, but we are in an expensive market. So Amazon is an expensive stock in an overall expensive market.

Here’s my bottom line: I like both Amazon and Walmart as stock picks. They’re both something you could just drop in a drawer and forget about for 20 years.

That said, if I am only picking one, it is Amazon.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where chief investment strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at feedback@dev.moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.