Every day, Green Zone Power Ratings helps me find companies with market-crushing potential, but maybe you want to try it out for yourself.

Today, I’ll show you our proprietary Green Zone Power Ratings system and how it can benefit you when buying stocks.

By the end, you’ll see how using it helps you make better-informed decisions and potentially improve your investment results.

What’s a Stock Rating System?

A rating system is a tool used to assess stocks and other investments.

It gives investors essential information on the risk and potential return of a stock or portfolio.

Ratings systems vary in functionality. Some rely on chart patterns to tell you whether a stock is one to buy. Others may assess a company’s price-to-metrics to see if a stock is overvalued (or if it’s flying under the radar).

But they’re all meant to help you do one thing: Buy good assets and avoid bad ones.

Our Green Zone Power Ratings system does this by focusing on six factors.

Three are technical (aka they are related to a stock’s current price and trading activity):

- Momentum— Strongly uptrending stocks earn higher momentum ratings. We prefer to buy stocks that are already trending higher and at a faster rate than the overall market. This approach can increase our odds of success and decrease risk.

- Size— Smaller companies earn higher size ratings. We prefer to buy smaller companies for the extra “juice” that typically comes with them.

- Volatility— Less volatile stocks earn higher volatility ratings. We prefer low-volatility stocks because they’re proven to generate superior risk-adjusted returns over the long run — with less heartburn.

The other three factors are fundamental. These analyze a stock’s financial standing and future prospects:

- Value— Less expensive (aka “cheap”) stocks earn higher value ratings. We prefer to buy great companies at good prices because the price we pay changes how much we get from future returns. Overpaying for a stock is a costly mistake.

- Quality— High-quality companies earn higher quality ratings. We prefer to buy high-quality companies, of course! To determine quality, the model considers a company’s returns, profit margins, cash flows, debt ratios and operational efficiency, among other things.

- Growth— High-growth companies earn higher growth ratings. All things equal, we prefer to buy companies that are growing both revenues and earnings at faster rates than the market and economy.

With the right stock rating system in place, investors can make more informed decisions when trading.

What to Look for in Green Zone Power Ratings

A rating system can provide information on stocks and help investors decide which stocks to buy.

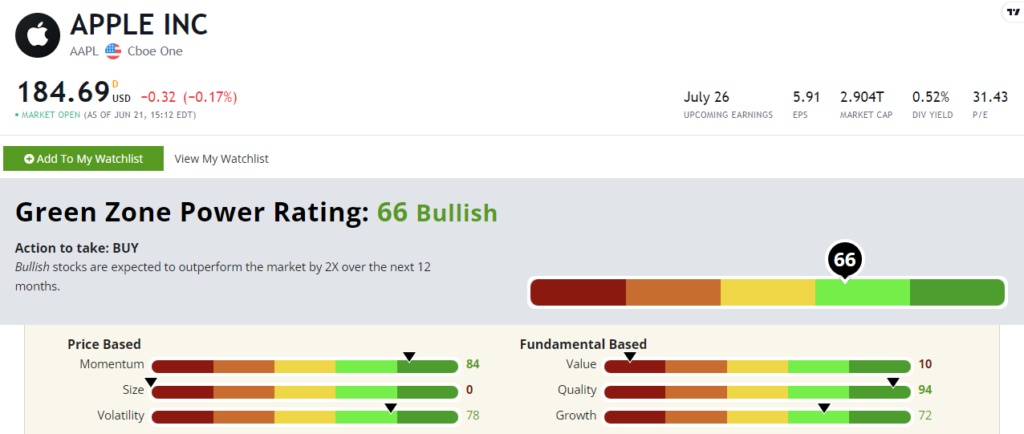

For example, our Green Zone Power Ratings system assigns stocks a 0 to 100 rating based on the criteria I mentioned above:

You can look at the stocks with high ratings and determine if they are worth investing in.

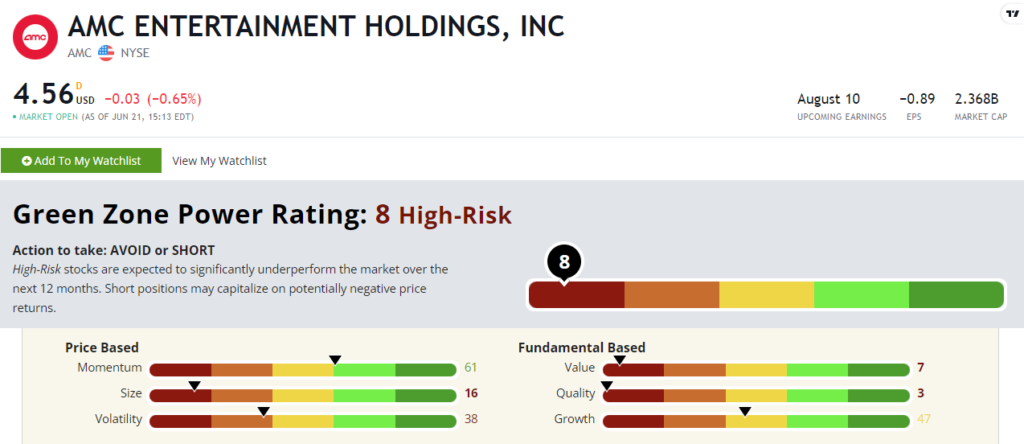

Conversely, finding stocks with low ratings can help you steer clear of risky investments that will drag your portfolio down:

In every case, the Green Zone Power Ratings system serves as a great source of knowledge when deciding what to buy.

How to Use the Green Zone Power Ratings System

When choosing stocks to invest in, our Green Zone Power Ratings system is incredibly powerful.

Stocks can be unpredictable, so it’s hard to make an informed decision when deciding which stocks to buy and sell.

If you want to see how some of your favorite stocks rate, go to www.MoneyandMarkets.com and look for this button.

Just click it to bring up a search bar, and then start typing in a ticker or company that you’re interested in knowing more about.

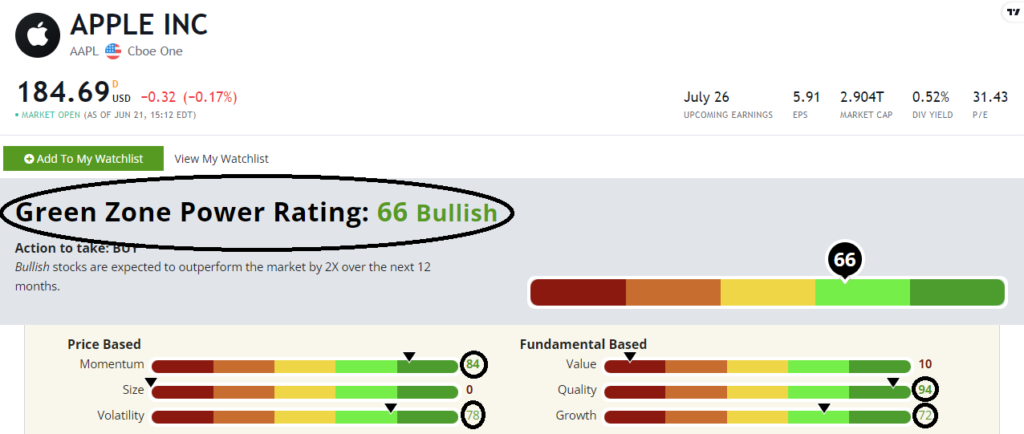

By utilizing our Green Zone Power Ratings system, you can focus on stocks with high ratings that have defined upside potential and downside risk.

Circled areas show where AAPL rates highly in Green Zone Power Ratings.

The higher the rating a stock has, the less risky it should be over the next 12 months.

Our ratings system can also help you stay up to date with market trends and find stocks that are well-diversified across multiple industries.

Doing research on stocks by using the Green Zone Power Ratings system helps you build a well-rounded portfolio tailored to your own personal financial goals.

Whether you’re just starting out as an investor, or you have years of experience, learning how to effectively use the Green Zone Power Ratings system when buying stocks gives your investments the best chance of success.

The bottom line: The Green Zone Power Ratings system is a great tool to use when buying stocks because it provides guidance and increases your chance of success.

It considers a number of different factors in order to give each stock a score between 0 and 100.

This score can help you make more informed decisions about which stocks to buy or sell. Check out our ratings today to get started making money in the stock market!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets