The cloud has revolutionized how we store data. How does Snowflake stock (Nasdaq: SNOW) look as businesses and individuals alike rely more on cloud-based storage in the digital age?

Snowflake is a cloud-based data storage and analytics company that has quickly become one of the most talked-about businesses in recent years.

The company was founded in 2012 and has grown a tremendous amount, both in terms of revenue and user base.

In this blog post, we’ll take a look at what makes Snowflake so successful and how it may perform in 2023.

We’ll also run Snowflake stock through our proprietary system to see how it stacks up.

What Makes Snowflake Successful?

Snowflake’s success can be attributed to several factors.

First, the company’s cloud-based platform makes it easy for businesses to store, manage and analyze large amounts of data — something that traditional databases struggle with.

Additionally, Snowflake is highly scalable, meaning it can grow with businesses as their data needs increase over time.

Finally, Snowflake’s pricing model is designed to be flexible — businesses pay only for what they use and don’t have to worry about buying additional hardware or software licenses as their needs grow.

The Outlook for 2023

Snowflake has made huge strides in the past few years, but that doesn’t mean there isn’t room for improvement. That’s even more true after Snowflake stock lost 46% of its value over the last 12 months.

Analysts expect the company to continue its growth in 2023, as more businesses move away from traditional databases and embrace cloud-based solutions like Snowflake.

Furthermore, analysts anticipate that the demand for cloud-based services will continue to rise over the next few years — a trend that could benefit Snowflake significantly.

But competition is also fierce. Amazon and other massive tech companies are bolstering their own cloud systems.

And the overall environment for tech stock is tough due to higher interest rates. It costs more to grow a business after the Federal Reserve hiked rates multiple times over the last year.

All of that is reflected in Snowflake stock’s score within our proprietary system.

Snowflake Stock Power Ratings

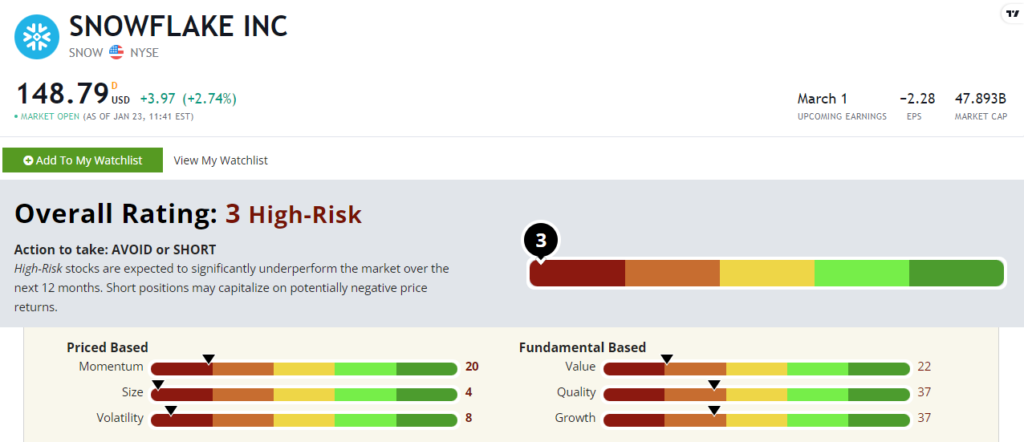

Snowflake stock rates a “High-Risk” 3 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

Snowflake’s earnings were negative $750 million for 2021, and they didn’t improve much for the trailing 12 months of 2022.

That means the company is losing a lot of money as it tries to grow its business. It also leads to low ratings on our fundamental factors: value (22), quality (37) and growth (37).

Snowflake stock has climbed higher over the last month by almost 8%, but that’s after months of negative momentum. Remember, SNOW lost 46% of its value over the last 12 months.

That negative track record is why it scores a lowly 20 on our momentum factor.

Bottom Line: Snowflake has already established itself as one of the leading cloud-based data storage companies in the world today.

But it’s a competitive market, and our Stock Power Ratings system says SNOW is one to avoid for now.