I’ve talked about the risks of investing in small-cap stocks versus large-cap stocks as tech stocks have led the rally over the last few months.

Large caps are bigger and safer. But they don’t always produce those massive gains we investors are on the hunt for.

Small-cap stocks, on the other hand, have volatility working against them. But they also have the potential to be triple-digit winners in your portfolio.

Today, I want to look at two small tech companies.

There are plenty of hidden gems among small-cap tech stocks, but finding the best buys is tricky.

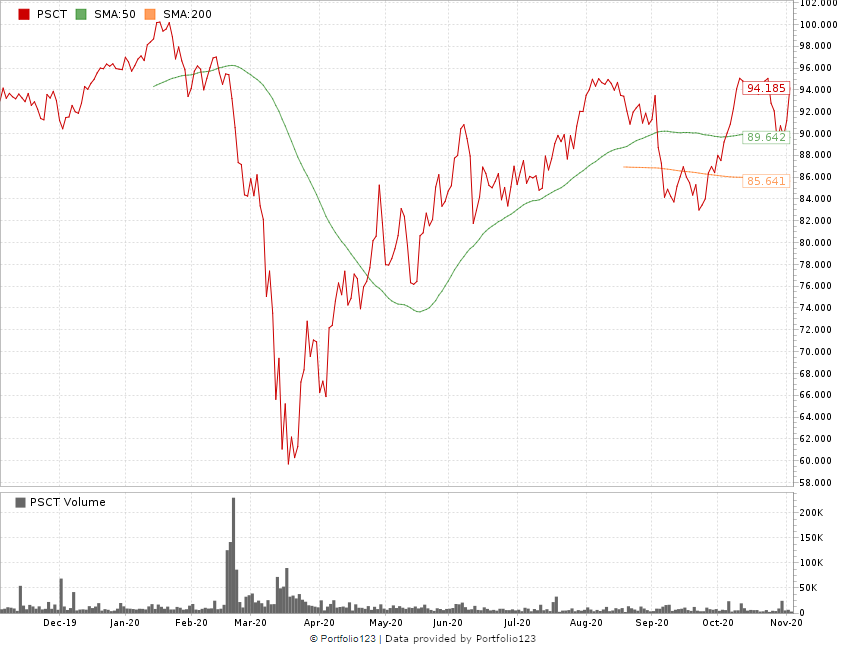

The Invesco S&P SmallCap Information Technology ETF (Nasdaq: PSCT) — an exchange-traded fund (ETF) tracking small-cap technology stocks — jumped more than 57% since reaching a low in March 2020.

After a dip in late September, the ETF rose 13% to its current price, indicating its back on the upswing.

The ETF holds a blend of small- to mid-cap technology companies that are primarily in the information technology sector.

Small-Cap Tech ETF Climbs 57% Since March

In this episode of The Bull & The Bear, I’ll talk with contributor Charles Sizemore about two unknown small-cap tech stocks and whether they are hidden gems or ones to pass on.

We’ll examine what these companies do and how they’ve performed recently.

These two stocks rate highly on the Momentum factor of our Green Zone Ratings system. Chief Investment Strategist Adam O’Dell has made Momentum the cornerstone of his investing strategy.

Adam has even written a book about how you can use momentum to find stocks you can “buy high, sell higher.” Next week, you’ll have an opportunity to pick up a copy of the book, so stay tuned.

What’s even better is you’ll get insight on what you should do with these two companies — if you are thinking about buying or already have them in your portfolio.

Remember, knowing the data and the details about a specific company helps you determine whether it is worth investing in.

That’s why we do the work for you by looking at these specific stocks and give you our analysis on each one.

The Bull & The Bear

Led by Adam and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos and information.

Have something you want us to talk about? Are there tech stocks that you think people are missing out on? Email us at thebullandthebear@dev.moneyandmarkets.com and give us your thoughts.

Check out dev.moneyandmarkets.com and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.