“We’re looking for golden needles in a haystack.”

It was something I had not heard before, but said I was going to steal because it explains exactly what we’re doing in 2023.

The Money & Markets team met recently … as we do often … to discuss stocks and an impending recession.

We debated buying large-cap stocks for their stability versus small-cap stocks for their post-downturn growth potential (I’ll dive deeper into this argument in just a sec).

That’s when my colleague and Money & Markets editor, Mike Merson, mentioned the “golden needles.”

It made perfect sense.

When I use our Stock Power Ratings system to analyze particular sectors or industries, I start with a broad exchange-traded fund (ETF) to get an idea of how the sector rates.

These ETFs can range from 14 holdings to more than 1,500 with certain small-cap ETFs, providing an array of results.

And just because the average rating of all the stocks in an ETF may be “Neutral” or even “Bearish,” that doesn’t mean there aren’t golden needles mixed into the fund haystack.

Today, I’m going to do three things:

- Get into the debate of small caps versus large caps using the lens of a potential recession.

- Show you what our Stock Power Ratings system says about it.

- Walk you through how to spot those golden needles in a haystack.

To get started…

Small-Caps Outperform Out of Recessions

After a mixed bag of economic news, there is an 87% chance the Federal Reserve raises interest rates another 25 basis points in May.

Economists and financial experts are confident an economic recession is looming … we just don’t know when it will hit — or for how long.

Interest rates remain high as the Fed tries to tamp down inflation. The Forbes Advisor recession tracker has 8 of 15 recession factors rated “bad,” meaning things aren’t looking rosy.

It leads to the question: What kinds of investments should we be looking for to maximize returns after a recession?

The answer to that question is easy…

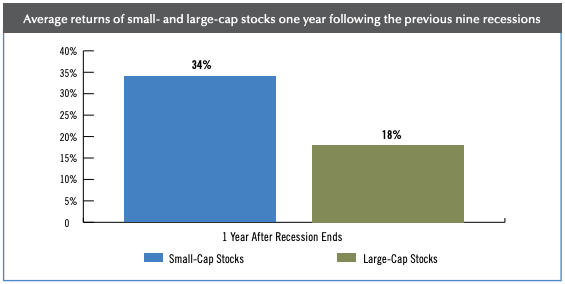

Check out this chart and you’ll see why:

Looking back at the last nine recessions, small-cap stocks have returned an average of 34% over the year after a recession ends, almost doubling large-cap stock performance.

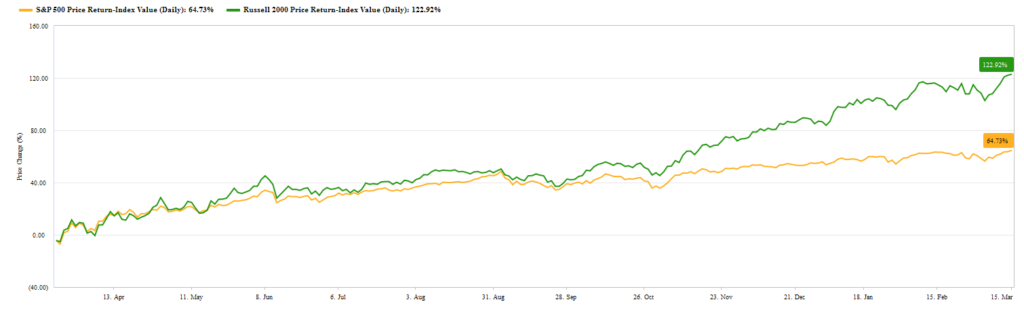

I drilled down further and looked at the 2020 coronacrash and compared the Russell 2000 and the S&P 500 over the year that followed:

The Russell 2000 Index (green line) gained 123% while the S&P 500 (the orange line) rose 64%.

Again, small caps nearly doubled the performance of larger stocks in just 12 months.

History tells us the best way to set up your portfolio for success coming out of a recession is to zero in on small-cap stocks.

How to Find the Best in Small-Cap ETFs

Now that we’ve identified the trend, I turned to our Stock Power Ratings system to zero in on potential investments.

Remember, small-cap stocks are companies whose market capitalization is between $250 million and $2 billion.

I looked at the Schwab U.S. Small-Cap ETF (NYSE: SCHA) — an ETF that holds more than 1,750 small-cap stocks traded on U.S. exchanges.

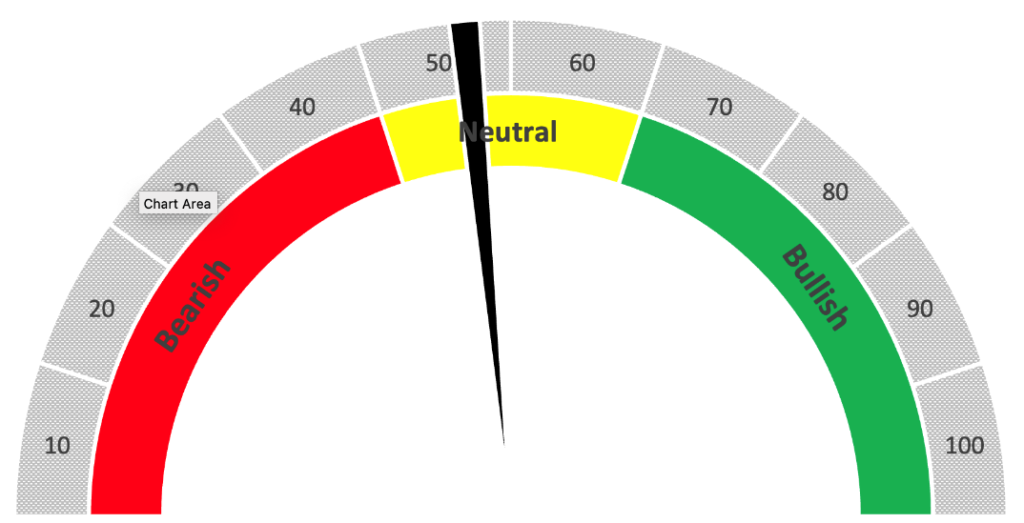

SCHA ETF Rates a “Neutral”

The average overall score of stocks in the ETF was 46 out of 100. This indicates our system is “Neutral” on these companies. That means the broader fund should perform in line with the overall market.

On the surface, this might turn you off to small-cap stocks. But this ETF holds 1,757 holdings as I write this.

But 458 are “Bullish” or above, 534 are “Neutral” and 631 are “Bearish.”

Of those Bullish stocks, 165 were rated a 90 or higher! Those are the golden needles we want to focus on.

Bottom line: To most economists, it’s not a question of if there will be a recession, but when.

And small-cap stocks, historically, have been the best investment for maximum gains following an economic downturn.

You could buy an ETF such as SCHA for diversification … and that’s fine … but you won’t see those gains with just an ETF.

The idea is to seek out those golden needles in a haystack … and our Stock Power Ratings system helps you do just that.

And on that note, my colleague Adam O’Dell just used Stock Power Ratings to cut more than 170 tickers out of his $5 Stocks to Watch Now report.

He’s using his system along with a brand-new strategy based on a set of arbitrary SEC rules to trim it even further. He wants to show you the exact golden needles that are set to soar over the next year.

He’ll have that shorter watchlist ready next week, but if you want to see the 298 tickers he started with, click here to see how to access the free report now.

Stay Tuned: How to Avoid Bad Small Caps

Adam recently laid out how the size factor of Stock Power Ratings helps us target small-cap stocks, but I’m going to show you how another factor plays a massive role in avoiding bad buys.

I’ll have that for you in Monday’s Stock Power Daily.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets