Managing Editor’s Note: If you aren’t checking out our Stock Power Daily each weekday morning, you’re missing out! Matt highlighted a steel distributor back in July that has weathered the market storm. It’s up almost 20% since he talked about it. The S&P 500 has traded flat in the same time frame. Keep reading to see why this “Strong Bullish” Power Stock is still a buy.

I was impressed every time I entered the BMW manufacturing facility in South Carolina.

The speed of the line…

The integration of robots with humans…

The steel and aluminum.

The company used massive amounts of metal sheets and rolls to build its X model SUVs.

The chart above shows the size of the steel market for aerospace and auto.

From 2021 to 2027, the market value will rise 37.1%!

If the steel market for those two industries is rising, you can bet that’s the case in sectors such construction, heavy equipment and oil and gas.

Ryerson Holding Corp. (NYSE: RYI), a global distributor of industrial metals, is today’s Power Stock.

RYI processes and distributes steel, stainless steel, aluminum alloy, nickel and copper for industries including aerospace and automotive.

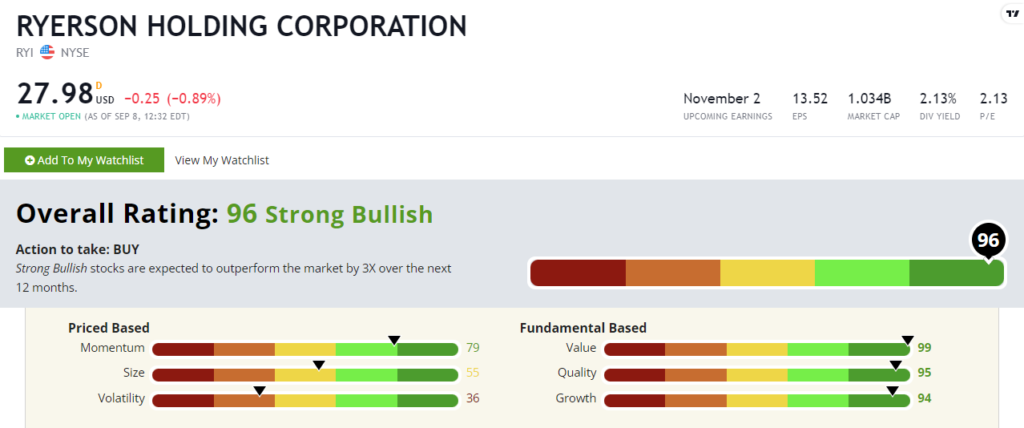

Ryerson Holding Corp. stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

RYI Stock: Strong Fundamentals + Solid Momentum

Ryerson stock took off in 2022.

Highlights include:

- Revenue of $1.8 billion in the first quarter of 2022 — a 52.4% increase compared with the same period last year!

- Increased gross margin to 23.5% in the first quarter — meaning the company can turn a profit.

RYI lights up the fundamental side of the Stock Power Ratings system in all green, as you can see above.

Its price-to-earnings ratio tells us it’s a bargain: It’s more than three times lower than the metal products industry average.

The price-to-cash flow ratio is a similar story: Ryerson’s is 1.9. The industry average, on the other hand, is an inflated 5.8

You can see why RYI stock earns a 99 on our value metric.

Its trailing 12-month earnings-per-share growth rate of 535.8% and sales growth rate of 55.3% make it a solid growth stock as well.

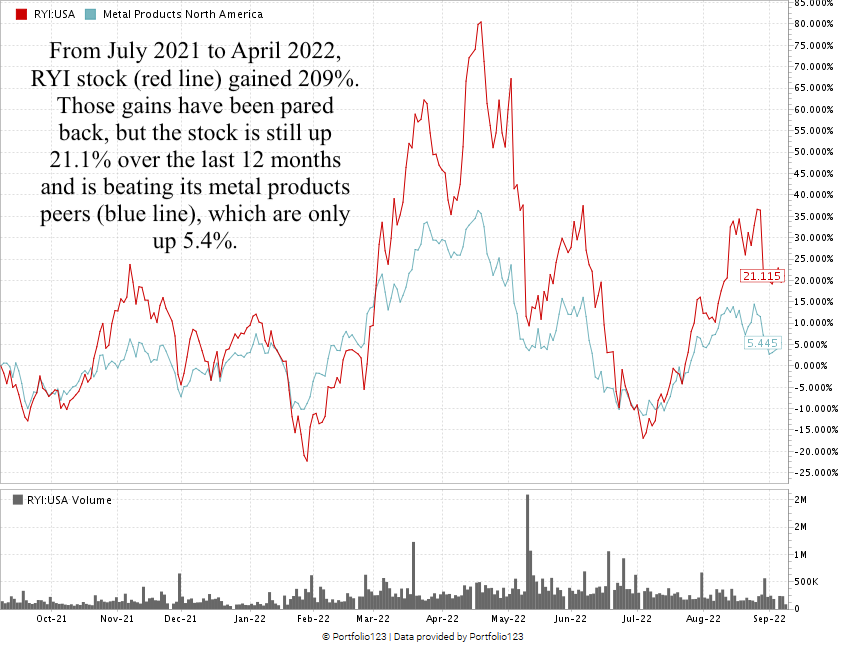

Take a look at the stock chart above.

After a massive run-up, the stock reversed due to market headwinds and fell 50%. But its uptrend has begun. Since I talked about the stock in mid-July, RYI has moved 19.5% higher!

Over the last 12 months, RYI is up 21.2%, while its metal products peers have only gained 5.4%.

Ryerson Holding Corp. stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Heavy industry relies on a strong supply of steel and other metals to build products.

The demand for steel — in aerospace and auto, in particular — is growing.

A leader in supplying steel and other metals to these industries, Ryerson Holding Corp. is a strong value and growth stock for your portfolio.

On Monday: Corporate Training Stock Takes Off

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that trains the next round of corporate leaders.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.

Story updated in September 2022.