Today, we’ll cover one of my favorite long-term dividend stocks: National Retail Properties (NYSE: NNN). National Retail is a real estate investment trust (REIT) focused on single-tenant, stand-alone retail properties.

The COVID-19 pandemic has hammered REITs — particularly those focused on retail.

Many retail tenants had to close their doors in the second quarter. Foot traffic and sales haven’t returned to pre-crisis levels yet.

National Retail’s tenant base is no exception. But that’s OK.

NNN’s balance sheet is a fortress. It has the flexibility to negotiate with its tenants.

In the second quarter, during the worst of the lockdowns, NNN was able to collect 69% of its rent and negotiate a payment plan for another 21%.

And in July, NNN was able to collect 84% of its rent. As life returns to normal, so will rent collection.

Meanwhile, National Retail has continued paying its dividend with the reliability of a Swiss watch. The company declared and paid its regular $0.52 quarterly dividend in July. At its current price, that works out to a 5.7% dividend yield.

In the Federal Reserve’s world of interest rates pegged at zero for years, that’s not too shabby!

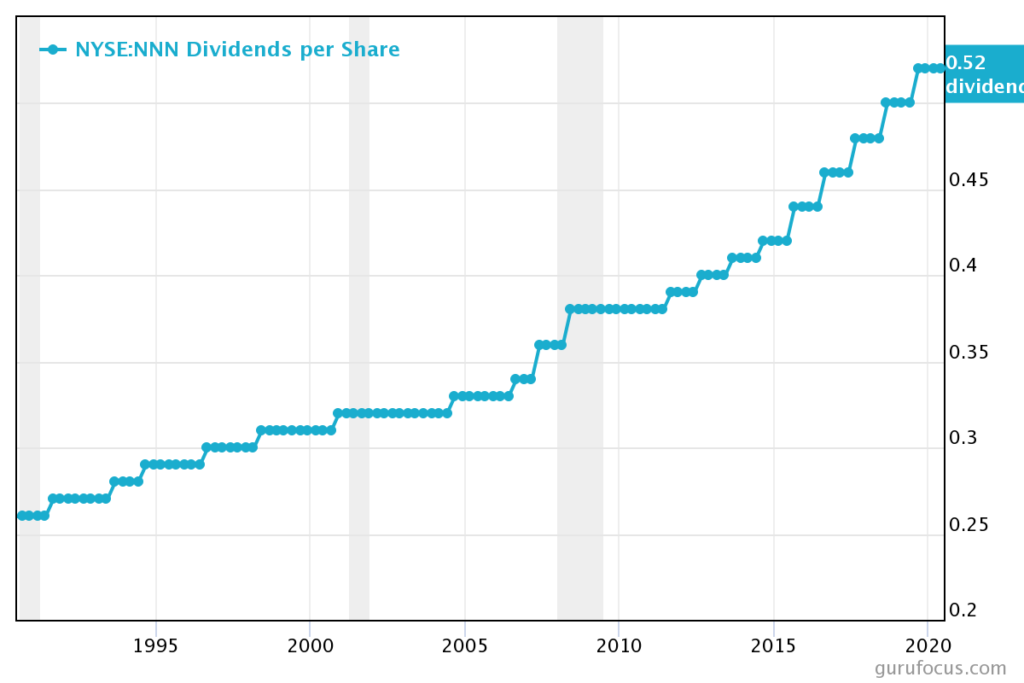

Take a look at NNN’s dividend over the past 25 years.

NNN’s Reliable Dividend

What Makes National Retail Properties a Good Dividend Stock?

In a word: consistency. A good dividend stock should be so consistent it’s boring.

A good dividend stock should be so consistent it’s boring. Save the sexy, world-changing companies for your growth portfolio.

Save the sexy, world-changing companies for your growth portfolio. In your dividend portfolio, your only concern is getting paid. And the companies most likely to do that without interruption are the quiet workhorses in boring businesses.

Let’s take a look at what makes up part of NNN’s boring, but profitable, portfolio:

- 18% of NNN’s portfolio is invested in convenience stores (7-Eleven is its largest single tenant, representing 5% of rents.)

- Another 10% and 9%, respectively, are invested in auto shop properties and fast-casual restaurants.

- The roughly 11% invested in full-service restaurants and 5% invested in movie theaters is wobbly at the moment. But these are not the small mom-and-pop restaurants most at risk from social distancing. The restaurant portfolio is made up of large national chains with the financial strength to muddle through.

National Retail has raised its dividend for 31 consecutive years. (Some of those years saw increases of a fraction of a cent that were more symbolic than practical, but we won’t split hairs.)

That means the company kept raising its dividend throughout the 2000s tech wreck, the 2008 mortgage meltdown and now the 2020 pandemic crisis.

Now, some disruptive disaster could eventually break the chain. But the past 30 years were a wild ride, and it hasn’t happened yet.

Yield on Cost

Bonds are a little safer than dividend stocks. But they have one major drawback: The payout remains the same over the life of the bond.

So your revenue stream loses ground to inflation over time. That’s a big problem if you’re living in retirement for 20 or 30 years. Due to the insidious effects of inflation, bond investors get a little poorer every year.

Let’s contrast that with a good dividend growth stock. A dividend grower will hike its dividend every year by at least the rate of inflation — and ideally a lot more over time.

Just for grins, let’s say you bought NNN 20 years ago, when it cost around $10 per share, and held it until today. Today’s annualized dividend of $2.08 would represent a 21% yield on your original cost. For every $100 invested 20 years ago, you’re making about 21% per year in cold, hard cash irrespective of any moves in the stock price.

Enjoying a yield on cost like that requires you to hold the stock for decades. And there aren’t a lot of stocks out there I’d be comfortable holding for that long.

But National Retail makes my short list.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.