Until the late 1990s, no one gave these traders the credit they deserved.

No, I’m not talking about Warren Buffett or George Soros.

These lesser-known traders follow a strategy that’s made money for centuries, though.

They include:

- Charles Dow (1851-1902).

- Jesse Livermore (1877-1940).

- Tom Dorsey (1980s to present).

The strategy they followed?

Momentum.

I call it the Momentum Principle, and it’s a simple concept: Buy high … sell higher.

But “momentum” and “technical analysis” were dirty words for years.

The Momentum Principle has only gained the respect and following it deserves in the last 25 years.

How We Know Momentum Works

If you’re like me, you want to know two things about the Momentum Principle.

- Does it really work?

- Why does it work?

To answer the first question … it’s worked for centuries!

I’ll explain more about that below. But first, I’ll share a more recent example, as it applies to my Green Zone Ratings model for stocks.

Every week, we publish a watchlist of the top 10 stocks to consider for your next investment. My team and I base this list on several factors, including stocks’ overall Green Zone Rating. (You can see the latest watchlist here.)

Some investors don’t want to buy a stock that’s in an uptrend because they think they missed out on the chance for big gains. But that couldn’t be further from the truth.

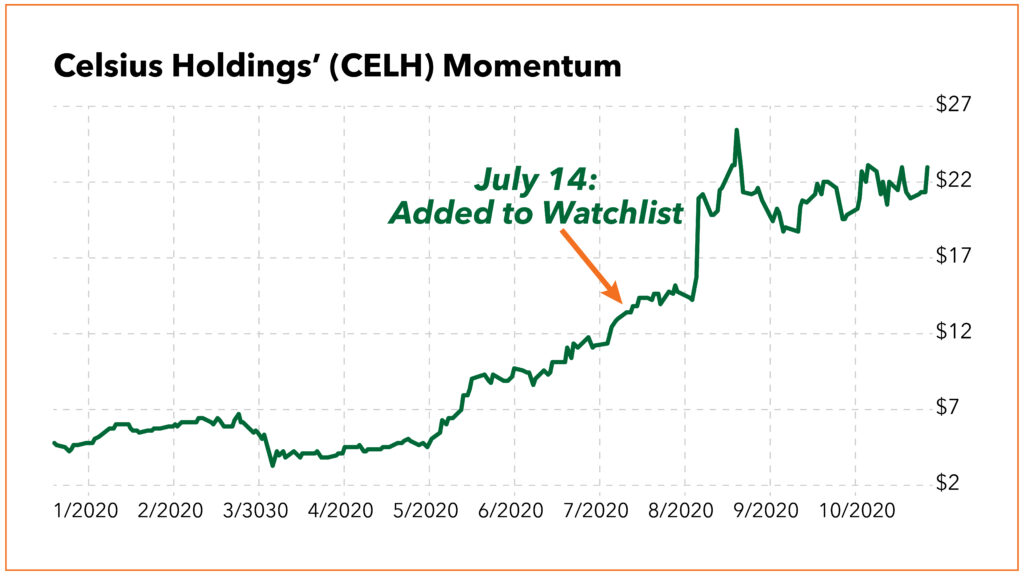

For instance, on July 14, 2020, one of my top 10 watchlist stocks was a fitness beverage manufacturer, Celsius Holdings Inc. (Nasdaq: CELH).

Celsius Holdings’ stock began this year trading at $4.26 per share.

Its share price on July 14 was $13.38. And at that time, Celsius’ stock ranked a 96 on Momentum — indicating it had strong upward movement in share price.

Now, some investors might have looked at that stock chart in July and been discouraged that they missed the stock’s big move.

However, since then, the stock has moved up to $22 per share — a 64% gain in just three months!

We Didn’t Miss the Boat on Celsius Holdings

Take a look at Celsius Holdings’ stock performance this year:

To compare, the S&P 500 has only gone up by 8% since July 14.

So this high-momentum stock is beating the market by more than eight times!

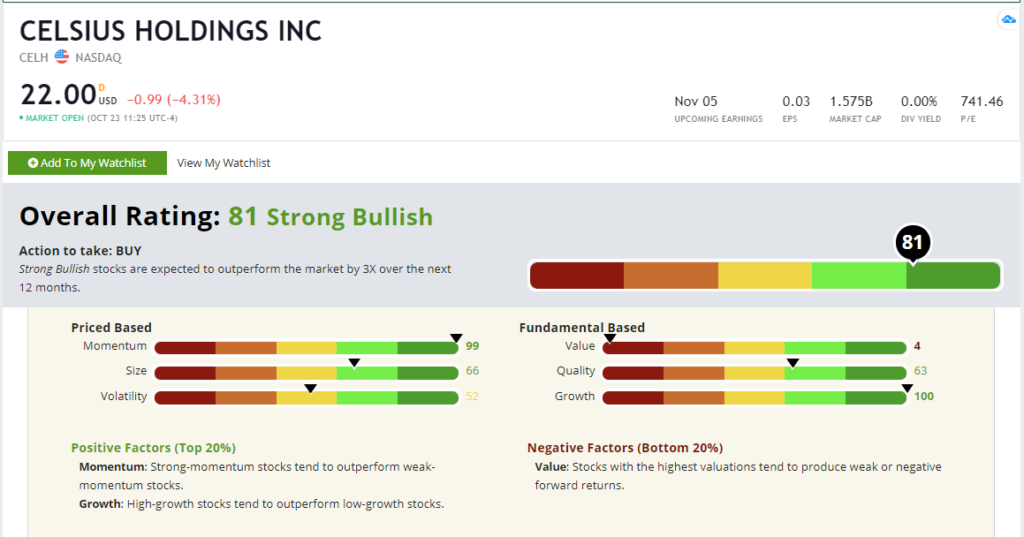

And my Green Zone Ratings model tells us this stock will continue to crush the market.

It now ranks a 99 on Momentum and an 81 overall!

Celsius Holdings’ Green Zone Rating on October 23, 2020.

Celsius makes beverages.

Another drink maker you’re surely familiar with is Monster Beverage Corp. (Nasdaq: MNST). Its shares traded for less than $1 in early 2005.

They rocketed as high as $7.93 in 2006. If investors didn’t buy the stock then because they feared they’d missed the move, well, it was their loss!

Today, shares of MNST trade for more than $80.

That’s nearly a 1,000% gain if you bought the company’s shares at their 2006 high!

Now, that’s just a couple of examples, but here’s the historical proof.

Momentum Trading: Proof That You Can Beat the Market

In 1993, the seminal paper on momentum was published: “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency” by Jegadeesh and Titman.

Finally, after spending years getting ridiculed as foolish for not believing that it’s impossible to “beat the market” — and that the key to doing so was as simple as “buy because it’s going up” — momentum traders were getting their due!

Jegadeesh and Titman proved that momentum works on individual U.S. stocks.

If this interests you as much as it interests me, I recommend checking out two papers:

But if you’re just here for the basics, know that the Momentum Principle has worked across multiple asset classes:

- Country stock market indexes (1997).

- Portfolios of mutual funds (1997).

- Foreign stocks (1998).

- Foreign currencies (1999).

- Industry groups (1999).

- Emerging-market stocks (1999).

- Commodity futures (2006).

- Commodity spot prices (2008).

- Bonds (2012).

And as for why the Momentum Principle (buying high and selling higher) works…

Our Behavior: Why Momentum Investing Works

Most of the prevailing explanations are “behavioral.” Meaning, they’re related to specific behaviors that investors exhibit.

These include:

- “Herding,” where individual investors tend to jump on the bandwagon when they see a larger group of other investors do the same thing.

- “Confirmation bias,” where individuals tend to believe information that confirms their pre-existing belief, more so than information that’s contrary to it.

- “Anchoring bias,” where investors place too much emphasis on one piece of information that is now outdated.

- “Disposition effect,” where investors feel an urge to sell winning positions quickly to feel the thrill of locking in a win and to hold on to losing positions for too long to avoid the feeling of taking a loss.

These biases, or “mental glitches” as I like to call them, are baked into the human psyche.

We all suffer from them. We have suffered from them for all of human history, and we always will.

Most importantly, they systematically create the mispricing of stocks. They cause stocks to be underpriced or overpriced. And it’s the mispricing of stocks that momentum investors take advantage of to earn market-beating returns!

The more you know…

Find Stocks for Momentum Investing

Now, stay tuned! Momentum is just one of the six factors my Green Zone Ratings system uses to rank stocks.

The others are:

- Size.

- Volatility.

- Value.

- Quality.

- Growth.

I’ll reach out to you later this week to explain the Size factor.

In the meantime, my team has been hard at work making sure you have all the tools you need to make profitable, smart investing decisions.

You can use the search bar on the Money and Markets homepage to search for stocks on your own and see how they stack up using my Green Zone Ratings system!

Remember, you can reach us at feedback@dev.moneyandmarkets.com any time.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets