Meta Platforms Inc. (Nasdaq: META) wants to create a new world inside the internet.

I tried it once, but virtual reality just makes me dizzy.

Big companies are paying attention to this innovative tech though.

With news that Walmart is entering the metaverse, you might think Meta’s stock performance is strong.

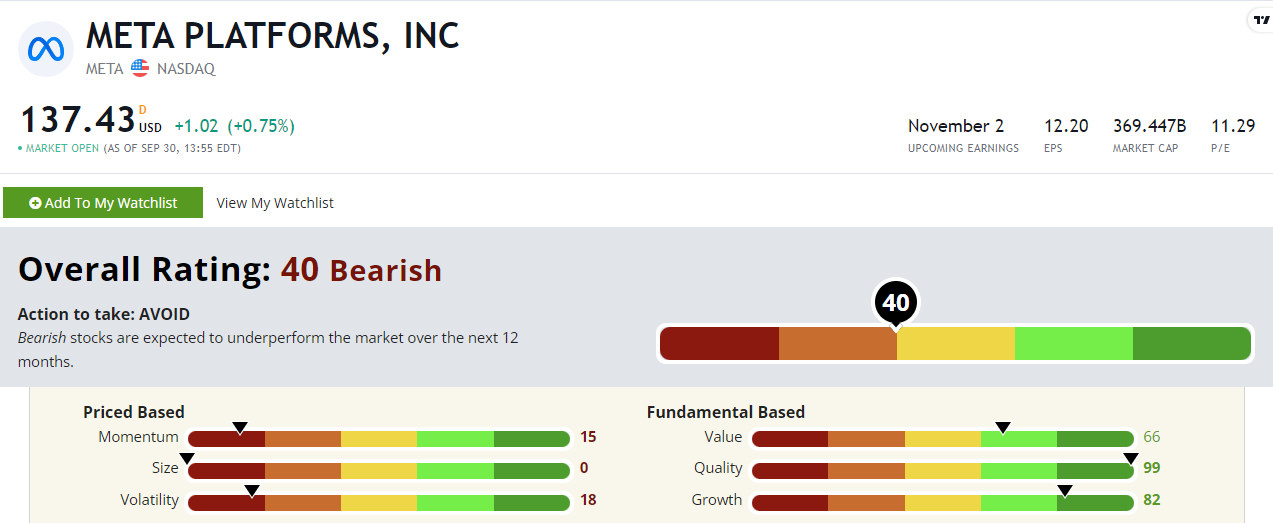

But Meta scores a “Bearish” 40 out of 100 on our proprietary Stock Power Ratings system.

To better understand how the stock performs today, we will look at META’s past.

META Stock Performance

META started as Facebook.

The company itself needs no introduction as one of the members of the noted FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks.

Despite its notoriety, META’s stock price has had its fair share of volatility since its initial public offering (IPO) in 2012.

But in 2018, the company had issues.

After mishandling private information, international political involvement, and an influx of user data breaches, META faced massive backlash.

While recovering from the scandal, Meta lowered its guidance for ad revenue which led to a 22% intraday stock drop in July 2018.

At the time, it was the largest loss of market value in U.S. stock market history at $119 billion.

It managed to beat its own record in February 2022, as Meta’s stock slumped again and led to an estimated $230 billion loss in its market value.

Let’s look at where Meta stands today using our proprietary Stock Power Ratings system.

META Stock Power Ratings Breakdown

We’ll zoom in on quality and momentum in a bit. As for the other metrics, META stock ranges from excellent to gnarly:

META’s Stock Power Ratings in September 2022.

- Growth —META rates an 82 on our growth metric. That makes sense considering it is a tech stock that has enjoyed a tech-heavy bull market for years. We’ll dive deeper into another one of META’s “Bullish” metrics below with a closer look at its quality metric.

- Volatility — META earns an 18 on our volatility score due to the stock’s rocky performance throughout the shaky market. I’ll get deeper into the stock’s movement in a second here with momentum.

- Size —With a market cap of almost $370 billion, META earns a 0 on our size metric.

Let’s see how Meta competes against industry peers through our quality metric.

META’s Quality

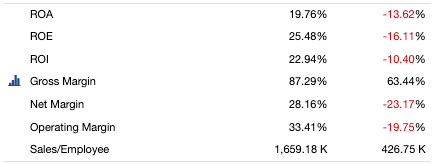

META’s “Strong Bullish” 99 quality rating is explained best through the numbers.

META’s Strong Quality Metrics

Meta’s return on assets is 19.76% compared to its peers in the internet and data services industry, that’s ranking in the negative.

The same story goes for its return on equity, that’s at 25.48% compared to the industry average of negative 16.11%.

Its return on investments is 22.94% compared to the industry average on negative 10.40%.

What all of these numbers add up to is simple: META is making a LOT of money specially compared to its industry peers.

This is why it earns a 99 on our quality metric.

META’s Momentum

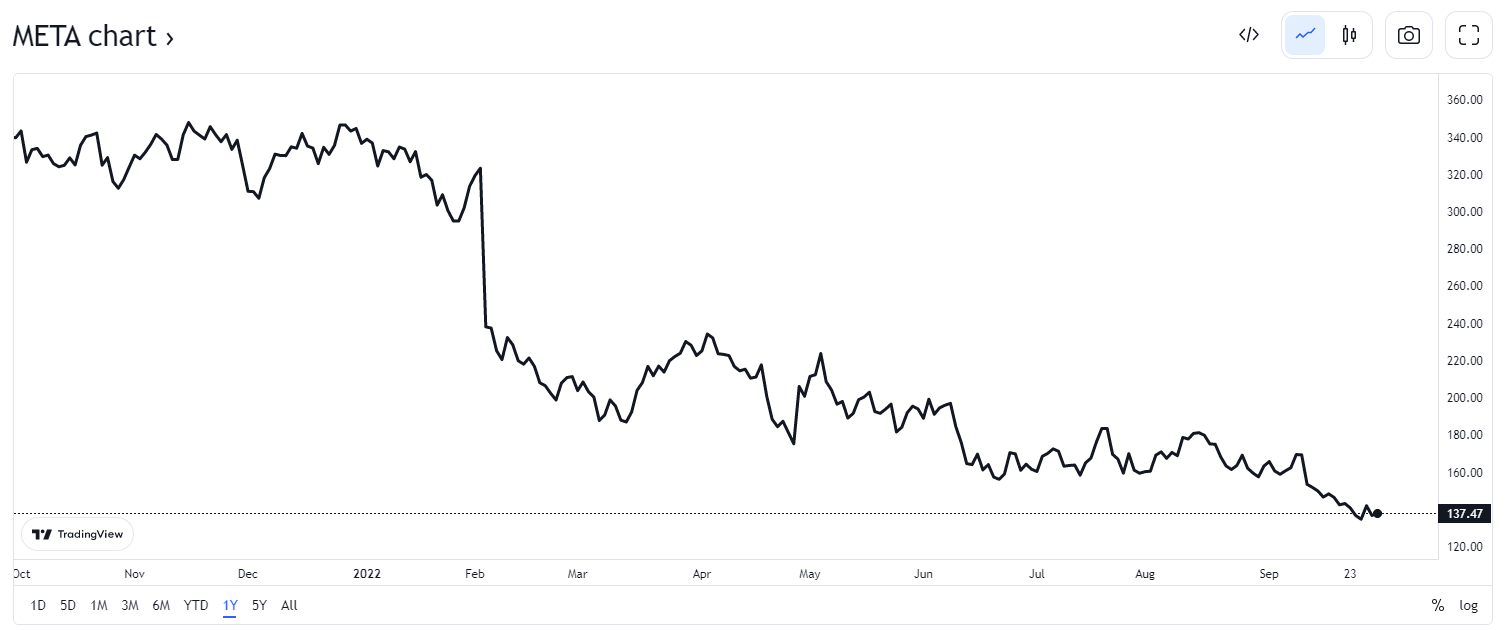

The last year has been tough on META’s stock.

The stock is down around 60% over the last 52 weeks.

Source: Tradingview.

After some upward trajectory in August it looked promising for Meta’s stock.

Meta stock’s downward trajectory earns the company a “Bearish” 15 on our momentum metric.

The Bottom Line

META earns a “Bearish” 40 out of 100.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!