It’s no secret that Lululemon Athletica has become a household name in the clothing industry. But is Lululemon stock (Nasdaq: LULU) worth owning as 2023 kicks into high gear?

Founded in 1998, this Canadian-based apparel company has experienced tremendous growth over the past two decades. Its popularity among athleisure-lovers shows no signs of slowing down.

But what is the story behind this successful brand? What do their investors need to know as they look towards the future? Let’s take a look at Lululemon’s history and outlook for 2023.

Lululemon’s Roots

Founded by Chip Wilson, Lululemon began as an idea to create high-performance athletic wear made from technical fabrics.

The brand quickly gained traction. Customers appreciated the comfort and quality of LULU’s garments.

It wasn’t long before Wilson saw an opportunity to expand beyond just yoga pants. Lululemon now offers men’s and women’s apparel designed for running, cycling, training and everyday activities alike.

Lululemon’s Financials and Future

Today, Lululemon is one of the most recognizable names in the activewear industry — and it shows no sign of slowing down anytime soon.

In 2020, it posted record sales despite the COVID-19 pandemic; revenue grew by 17% year-over-year to $3 billion USD. This impressive growth was due in part to increased ecommerce activity as well as strong performance from LULU’s menswear line.

And strong growth has continued throughout 2022. In its latest quarterly report, LULU stated net revenue had increased 28% in the third quarter compared to Q3 2021. Comparable sales also increased 22%.

Looking ahead to 2023, analysts predict that global demand for athleisure will continue to rise — which spells good news for investors. We’ll see if that’s reflected in LULU’s Stock Power Ratings in a moment.

Beyond just sales figures, there are other factors that demonstrate why Lululemon looks like a decent investment.

The company has established itself as a leader in sustainability initiatives; its goal is to use only low-impact materials and processes.

Additionally, its commitment to creating an inclusive workplace culture has resulted in improved employee morale — which further translates into better customer satisfaction ratings and loyalty.

All these factors point towards a bright future for LULU.

Lululemon Stock Power Ratings

Let’s see how Lululemon stock looks within our Stock Power Ratings system.

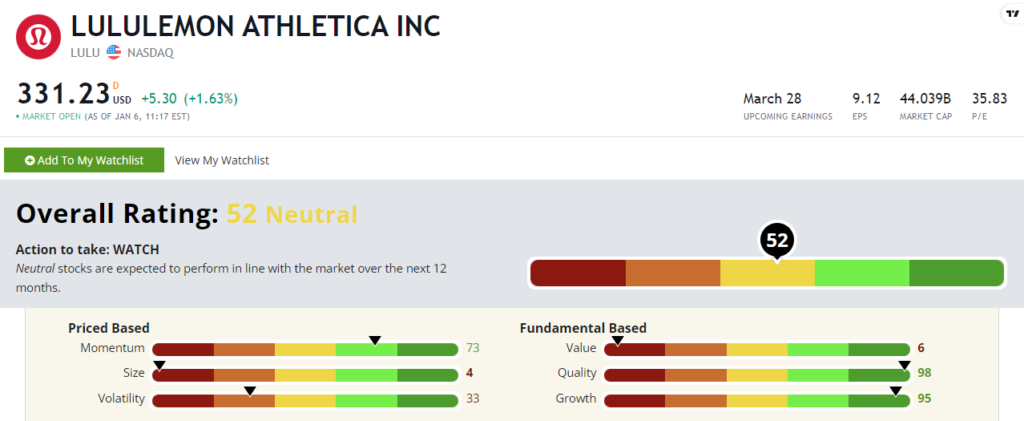

It rates a “Neutral” 52 out of 100, which means our system expects LULU to follow the market’s broader performance over the next 12 months.

I mentioned some of LULU’s strong quarterly numbers above. That’s why it boasts incredible scores of 95 on growth and 98 on quality.

But like many stocks that gained popularity amid the stay-at-home COVID movement, LULU’s market valuation is now much higher than its revenue can support. For context, Lululemon stock soared 186% from its March 2020 low to its November 2021 high.

Now it has reversed course, but it’s still sitting at a monster valuation And its 6 score on our value factor reflects that. It’s in the top 6% of most expensive stocks that we rate.

Lululemon stock is faring better than some of the other COVID darlings, but we’ll have to wait and see if it turns into a bearish or bullish stock as 2023 rolls along.