The 2020 election cycle was one for the history books.

And I don’t mean the race for president.

Perhaps the biggest winner in the election was cannabis.

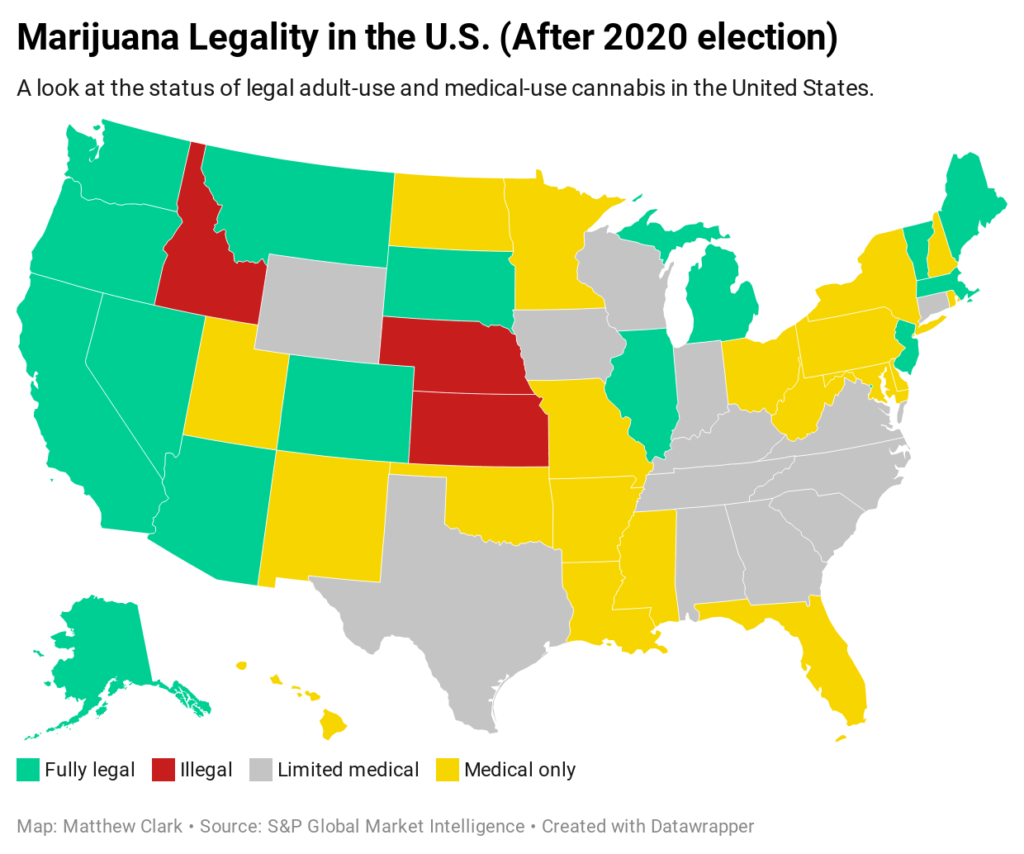

Five states voted on six cannabis legalization measures, and every one of them passed.

Recreational use is now legal in Arizona, South Dakota, Montana and New Jersey.

Voters approved medical use in South Dakota and Mississippi.

Those results mean that 70% of the population in the U.S. now live in a state where cannabis use is legal in some form:

It’s a boon for the cannabis industry, as even conservative states voted in favor of cannabis.

That prompted me to find a breakout cannabis stock to add to the November edition of our Cannabis Watchlist.

It’s one with awesome momentum that I’m convinced will outperform the market by at least 2X over the next 12 months.

First, it’s important to understand how the election will transform the cannabis industry.

Cannabis Revenue on the Rise

I’ve addressed this in previous episodes of our Marijuana Market Update. To watch those updates and all of our videos, check out our YouTube channel.

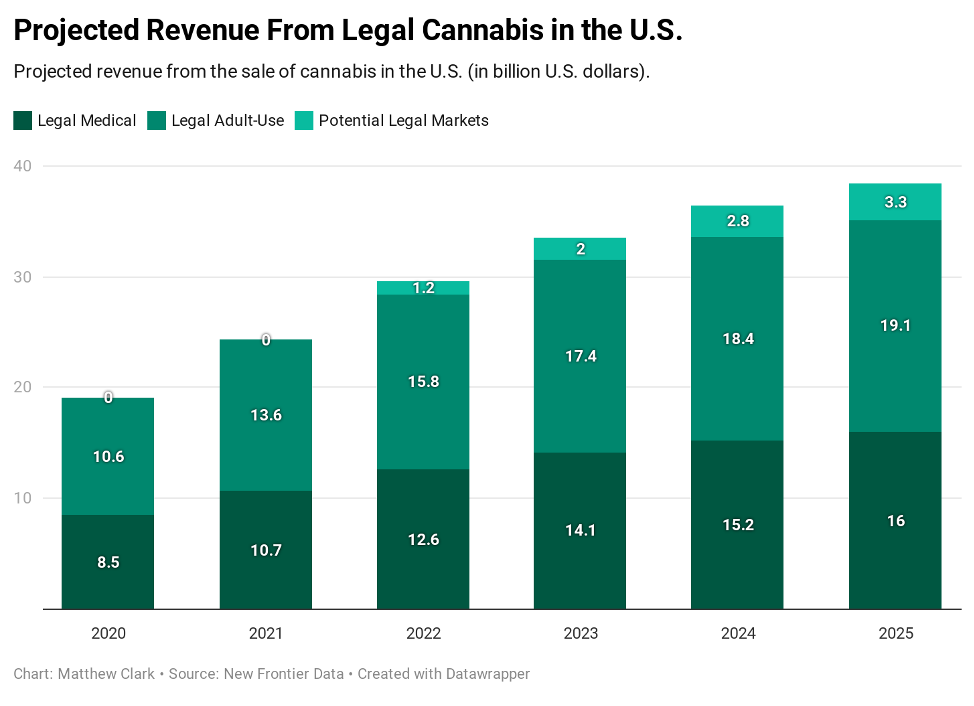

New Frontier Data, a cannabis research firm, found that if all of those measures passed, it would add $9.3 billion in revenue to the legal cannabis market through 2025.

It projects that the cannabis industry’s revenue will surge to $38.3 billion by 2025. For perspective, 2020 revenue will be around $19.1 billion.

That’s 100% growth in just five years.

With sales growth in Illinois, Nevada, Colorado and California along with a booming medical cannabis market in Florida, I think that revenue increase could be even higher!

Now, I want to share how our watchlist has performed over the last three months.

How Our Watchlist Is Performing Now

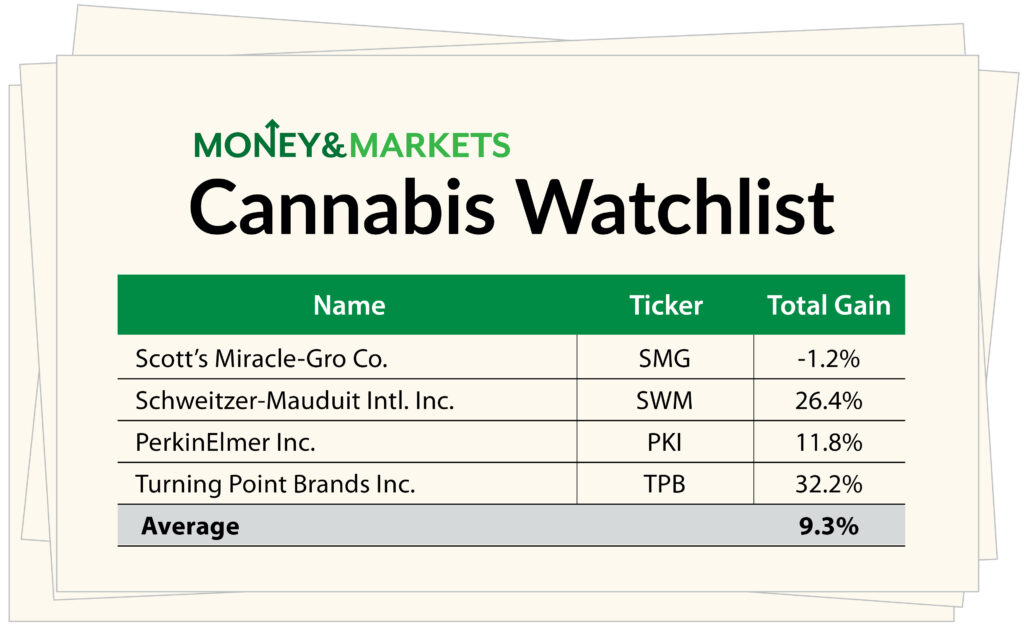

It’s been a great three months for our Cannabis Watchlist.

Three of our four positions are producing double-digit gains, and the fourth is on the cusp of breaking into positive territory.

- Turning Point Brands (NYSE: TPB) was our October watchlist addition. It’s a traditional tobacco company that has started making products for the cannabis industry. So far, it has outperformed the rest of the cannabis industry and produced gains of more than 30% since I added it to the list.

- Schweitzer-Mauduit International Inc. (NYSE: SWM) is another tobacco company that has developed products for cannabis use. SWM is a strong performer. Since I put it on the watchlist in September, the company’s share price has jumped more than 26%.

- PerkinElmer Inc. (NYSE: PKI) tests various strains of cannabis for consumption. Since I put it on the Watchlist in September, the company’s shares are up more than 11%.

- Scotts Miracle-Gro Co. (NYSE: SMG) is a popular fertilizer company that’s been hit by adverse weather conditions in the Midwest, West and South. It’s close to cracking into positive territory, though — down just 1%.

All told, our watchlist is performing well.

Taking all the gains into consideration the overall watchlist is up more than 9%.

The ETFMG Alternative Harvest ETF (NYSE: MJ) — a popular ETF that invests in cannabis stocks — is up just 5% during that time.

Our New Cannabis Watchlist Stock

The recent run in cannabis stocks — thanks in no small part to the 2020 election — reveals an opportunity that will outperform the broader market by two times in the next 12 months.

GrowGeneration Corp. (Nasdaq: GRWG) is a company that develops and sells hydroponic and gardening equipment (think lights, seeds, nutrients and filters).

GrowGeneration followed up a big 2019 with a more impressive 2020:

- Sales grew from $29 million in 2018 to $80 million in 2019 — a 175% increase.

- GRWG notched sales of $33 million in the first quarter of 2020 and $55 million in the third quarter — a 66% jump.

- It has a one-year annual sales growth rate of 147%.

That means it’s already surpassed its 2019 sales numbers … in just the first three quarters of this year!

Its earnings are just as impressive:

- The company reported an earnings loss of $0.22 per share in 2018, but an earnings gain of $0.05 per share in 2019 — a $0.27-per-share turnaround.

- It has consistently reported earnings of $0.06 per share in each of the last two quarters.

- GRWG has a one-year annual earnings-per-share growth rate of 339%!

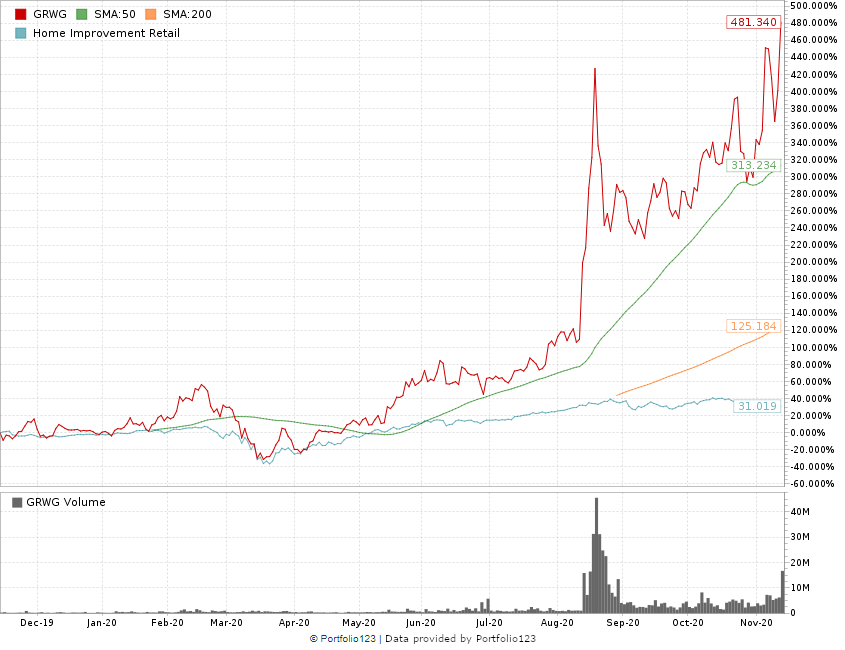

GrowGeneration’s stock price hit a low of $2.87 in March 2020. It jumped nearly 800% to its current 52-week high of around $26 per share.

GrowGeneration Share Price Jumps 800%

GrowGeneration Cannabis Stock: Green Zone Rating

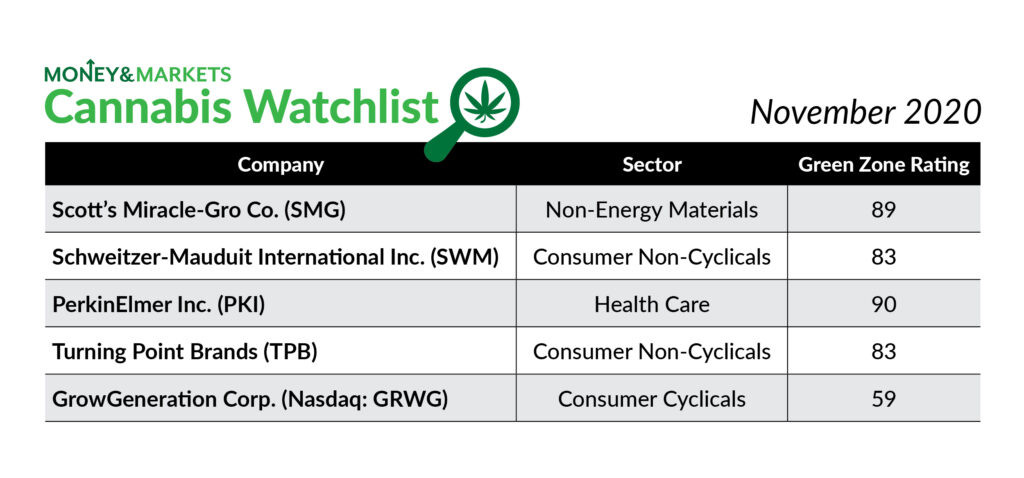

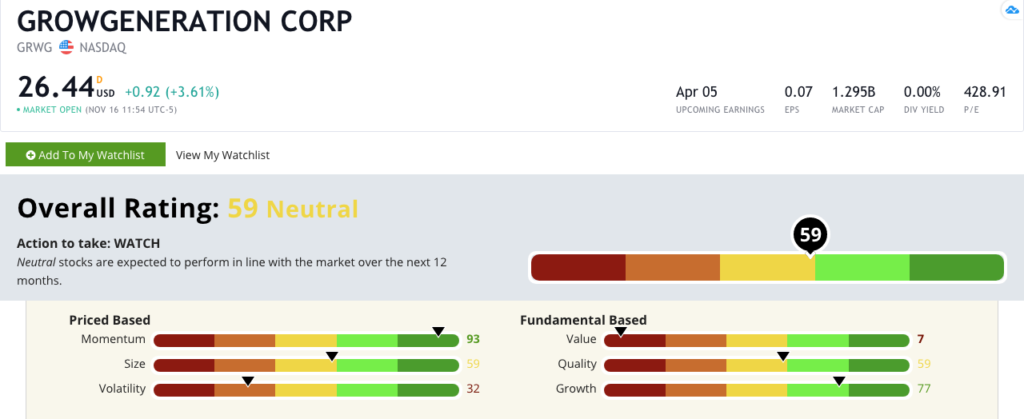

If we look at Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system, we see that GrowGeneration ranks a 59 overall, meaning we are “neutral” on the stock.

Now, remember: This is a cannabis stock, and comparing it to all other stocks isn’t necessarily fair.

That’s why we focus on Momentum — where it ranks a 93 — and its Growth — where it ranks a 77.

GrowGeneration’s Green Zone Rating on November 16, 2020.

Remember, our philosophy here is what Adam calls the Momentum Principle: “Buy high … sell higher.”

(Pro tip: Adam just unveiled his Millionaire Master Class, where he reveals the strategy that helped him “retire” at 33. To find out more, click here.)

And GrowGeneration has shown a definite uptrend since March 2020.

The Bottom Line: With new states coming into the fold by legalizing cannabis, the market will skyrocket over the next five years.

Cannabis companies will look to GrowGeneration for supplies to meet the demand of the expanded market.

This means the company will continue expanding its sales base — even on top of a potentially record-breaking 2020.

Smart investors (like us) who recognize this trend will get into GRWG now to realize gains two times better than the broad market in the next 12 months.

My team and I would love to hear from you: Have you bought any of the stocks on our Cannabis Watchlist? If so, how are they performing? Email feedback@dev.moneyandmarkets.com to let us know what stocks you’d like us to consider for future editions of the Cannabis Watchlist or the weekly Marijuana Market Update … because we use your requests and feedback to shape everything we do here at Money & Markets!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.