In the latest Marijuana Market Update, I discuss:

- The biggest battleground state for cannabis companies.

- My answer to a viewer’s question about the SAFE Act.

Check it out below.

Florida Cannabis Legalization

The next state cannabis companies salivate over isn’t California, New York or Michigan.

Cannabis companies are waiting on pins and needles for adult-use legalization in Florida.

First, it’s important to note that only medical cannabis is legal in Florida. The process for a company to get a license to sell in the Sunshine State is both stringent and costly.

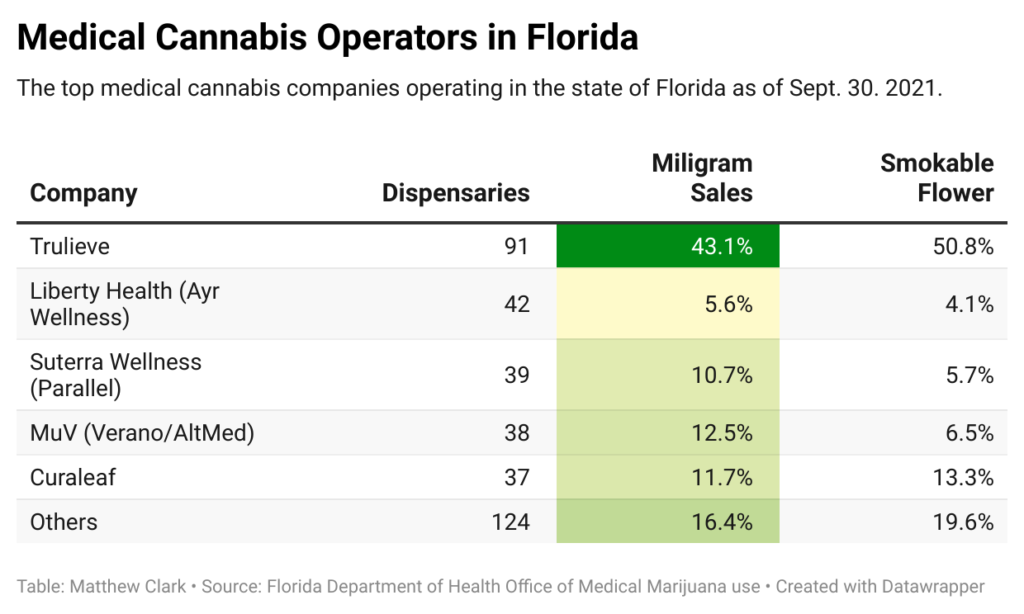

You can see in the table above that Trulieve Cannabis Corp. (OTC: TCNNF) is the largest supplier of medical cannabis in Florida, with 43.1% of milligram sales.

The next largest operator is Liberty Health, or Ayr Wellness Inc. (OTC: AYRWF) with only 5.6% of the state’s milligram sales across 42 dispensaries.

Trulieve’s share of the state’s smokable flower is a little more than 50%, which is where it’s been over the last 18 months. That’s considerably higher than any other cannabis operator in any other state.

Also of note: Ayr is buying Liberty, Cresco Labs Inc. (OTC: CRLBF) is acquiring Bluma Wellness (One Plant Florida) and Planet 13 Holdings Inc. (OTC: PLNHF) is entering the market by buying Harvest Health & Recreation’s vertical medical marijuana license.

MedMen Enterprises Inc. (OTC: MMNFF) also received $100 million in new equity to expand into areas like Florida — it opened a dispensary in Orlando in September.

But we can see that Trulieve has a corner of the Florida market … and it is a sizable market, as you can see in the chart below:

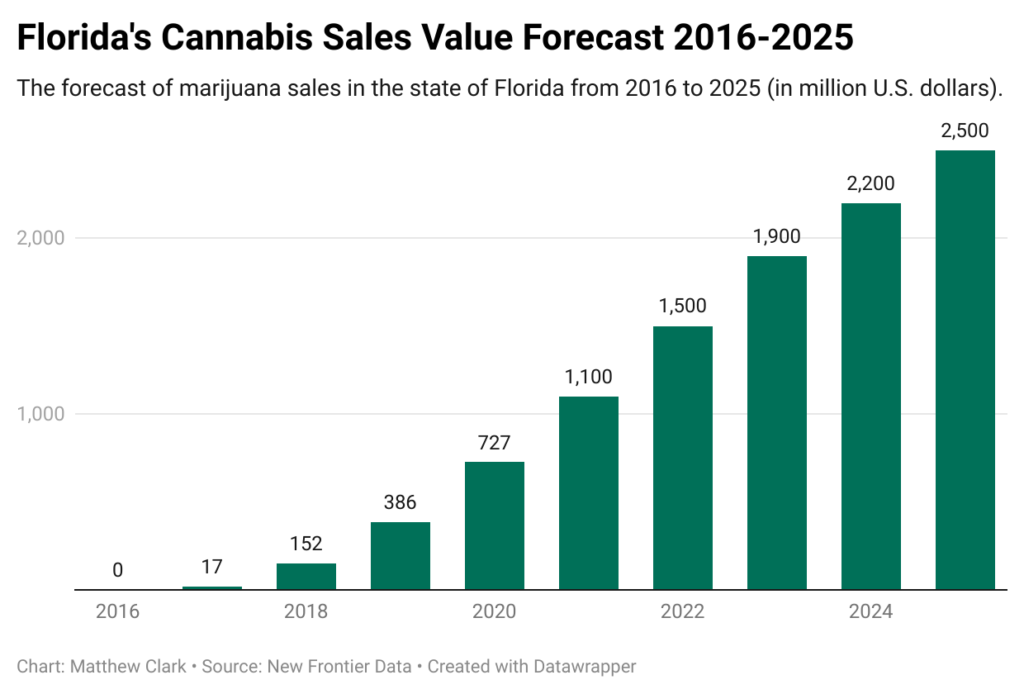

New Frontier Data — a cannabis data company — found that total cannabis sales in Florida could reach as high as $2.5 billion by 2025.

This assumes that adult-use legalization will happen in the next year or so.

Regardless, that’s a 127% jump in sales from 2021 to 2025 — suggesting Florida’s cannabis market is ripe for the picking.

Legal Cannabis in Florida Would Create a Huge New Market

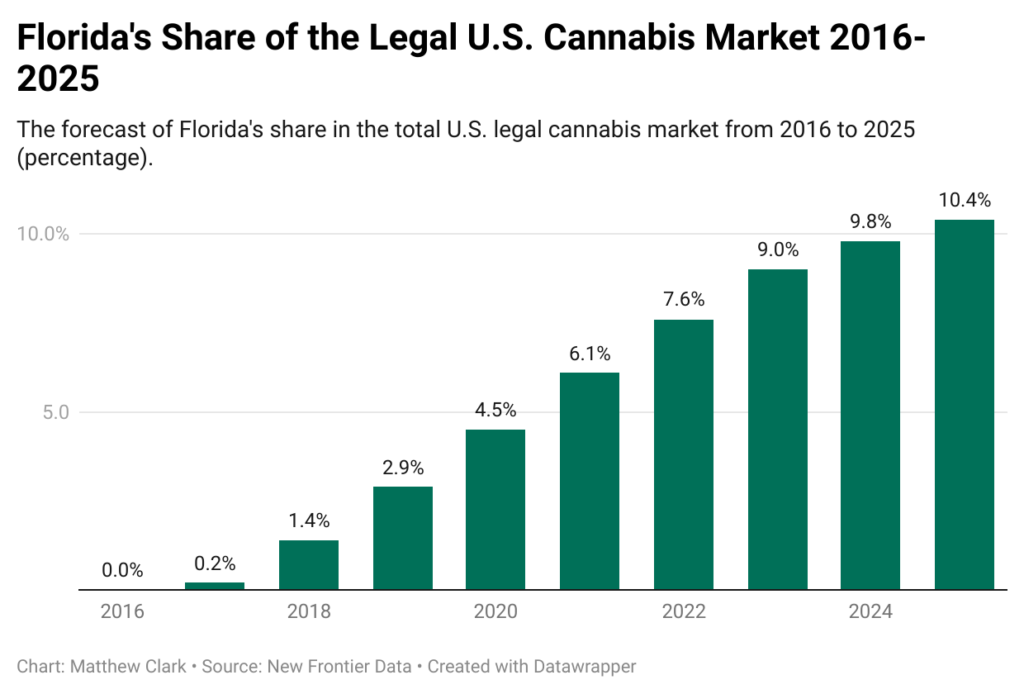

If we translate that into market share, New Frontier Data suggests Florida’s total share of the legal cannabis market will be more than 10% by 2025 — again assuming recreational cannabis is legalized.

That would be more than 10% of all cannabis sales in the U.S. — including California, New York and Michigan.

While Trulieve is the biggest player by far in Florida, it still leaves nearly 50% of this large market on the table.

As that market expands, Trulieve may continue its dominance. But the available market share will grow, leaving more for other cannabis companies to scoop up.

When Florida legalizes adult-use cannabis, I think it will be one of the top three markets in the U.S.

Just analyzing the state’s medical market can show the growth potential.

According to state data, right now there are 371 dispensaries across Florida. That’s a 33% increase from 278 a year ago.

What’s more is the number of qualified patients getting their medical marijuana card jumped 46% to 619,278 during the same time.

Florida boasts more patients per store today than a year ago.

Trulieve has the market cornered, but other MSOs are expanding in the state. Liberty Health added 16 new dispensaries over the last 12 months, while MuV tacked on 12 new stores.

Curaleaf added four new dispensaries but suggests it wants 60 by the end of 2022.

Takeaway: Imagine the massive potential when the Sunshine State legalizes adult-use cannabis.

Even if it doesn’t happen right away, Florida is still a prime spot for cannabis operators to eye profitable expansion — so long as they’re willing to undertake the expense of getting a license here. We’ll have to wait and see what’s next for Florida cannabis legalization.

SAFE Act Q&A

Now, on to a viewer question.

Annesley asked me:

Let’s imagine the SAFE Act does not get passed alongside the defense authorization spending bill. This continues to stall for 12 months and, in between, more states legalize. Will institutions still “stay away” in terms of investing, thus keeping stock prices steady, or will there be a new catalyst we haven’t seen yet which will move these stocks. — Annesley

Great question, Annesley. Watch out for an email from my team to get you hooked up with free Money & Markets gear.

Now, for context, the SAFE Act lifts restrictions on financial institutions for doing business with cannabis companies. In short, it allows cannabis companies to apply for extended lines of credit and so forth, whereas now they can’t.

The House of Representatives tacked the SAFE Act onto the National Defense Authorization Act — a bill that sets policy for defense and authorizes spending based on Pentagon priorities.

The NDAA passed the house with bipartisan support and always gets approved — hence why House members elected to tack on cannabis banking.

However, the Senate is another matter. Senate Majority Leader Chuck Schumer of New York elected to halt any passage of cannabis banking until more social justice reform related to cannabis is approved.

Annesley’s question is an interesting one supposing that the SAFE Act is stripped from the NDAA and lingers for months.

In that scenario, I think cannabis stock prices will see little upside movement — and the potential for more downside activity.

The SAFE Act is paramount for cannabis companies to obtain capital for operations and expansion. Without extended lines of credit, companies can only pay for operations and look into potential expansion with profits they make.

It’s one of the main reasons that cannabis companies struggle with profits. They are spending their profits to pay for things other businesses can pay for by accessing capital from a bank.

Passing the SAFE Act would give investors a spark to put capital into a company because the companies would have access to traditional business capital from banks.

Takeaway: If the SAFE Act languishes in Congress and doesn’t pass as part of the NDAA, there is little change for cannabis companies. If they want to expand, they have to dip into their profits, thus trimming their bottom line.

As I said in my video last week, the cannabis industry is looking for any kind of a positive headline to spark prices up.

Until that happens, you can expect the status quo of volatility and little upside.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@dev.moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.