In the long run, your success as an investor hinges on the net difference between your winners and your losers.

It’s human nature to focus most of our energy on finding our next “big winner,” than it is to spend time and effort on simply “avoiding losers.”

But truly, the losses we avoid are equally as important as the profits we capture.

Economically, it’s difficult to recover from large losses.

Consider that it takes a 100% winner to recover from a 50% loser … and a 300% profit to recoup a 75% loss.

That’s why I love the trend-followers mantra, which says to “cut your losses short and let your profits run.”

What’s more, there’s always psychological damage involved in taking large losses. How many times have you been wiped out by a trade that went awry … only to find yourself feeling too burned to pull the trigger on the next opportunity you saw?

As I said, it’s human nature to focus on finding winners. But to be a truly successful investor, it’s equally critical you have a method for avoiding losers.

And that’s the focus of this “Laggard of the Month” segment I’ll be writing each month here in Money & Markets Daily.

I’ll highlight one poorly-performing, “laggard” — either a sector, industry group or occasionally an individual stock I think you should avoid like the plague.

Today, we’re looking at…

The Energy Sector

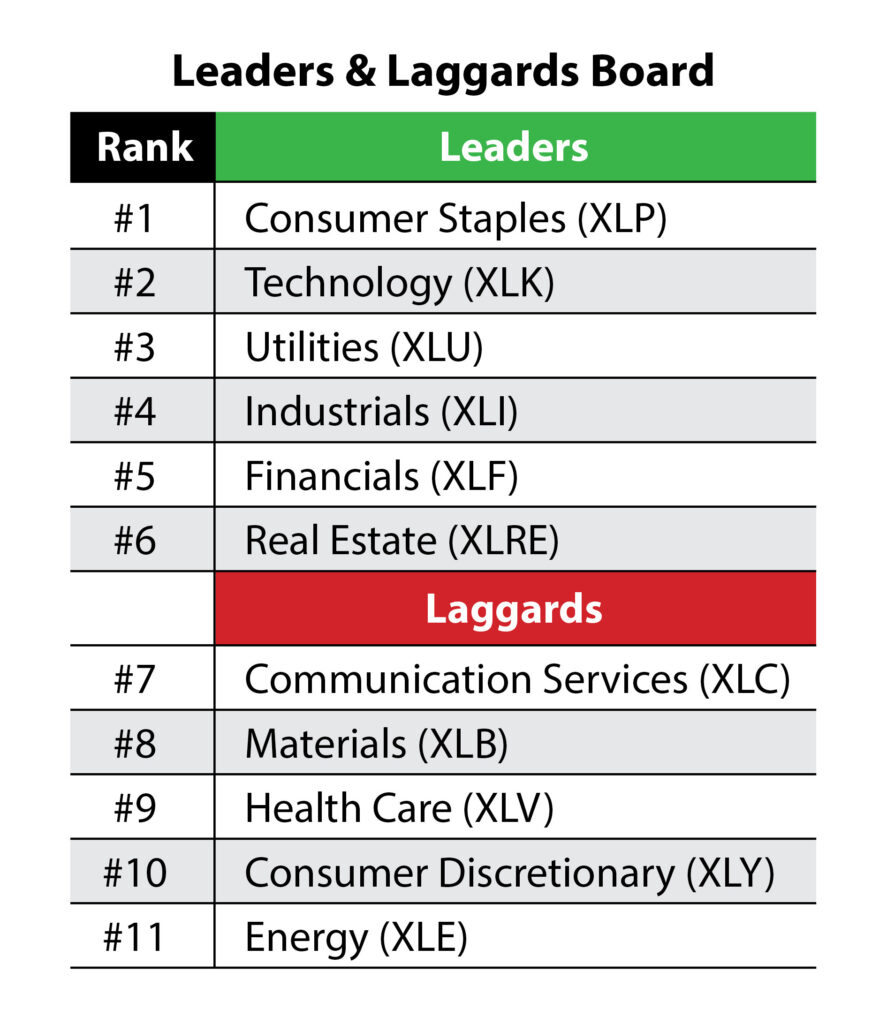

Each week, in my Tuesday email to Cycle 9 Alert subscribers, I publish a Leaders & Laggards Board of the 11 major U.S. stock sectors.

Last week’s looked like this:

(Published September 8, 2020)

Note: The three letters after each sector indicate an exchange-traded fund (ETF) — a basket of stocks — that I track to see the performance of the sector as a whole.

You’ll see the SPDR Energy Sector ETF (NYSE: XLE) ranked at the very bottom of this list.

XLE includes oil stocks such as Chevron Corp. (NYSE: CVX), Exxon Mobil (NYSE: XOM) and Phillips 66 (NYSE: PSX).

This is the ultimate “laggard” sector, according to my predictive momentum algorithm.

And this wasn’t atypical. In fact, the energy sector has made quite a comfortable home of this No. 11 spot for many months now!

Now, this Leaders & Laggards Board I publish each week in Cycle 9 Alert is based on my forward-looking momentum model, so it shows my algorithm’s prediction of how each sector will perform in the future.

Energy Stocks: The Worst of the Bunch

But even when we look at historical trailing returns, it’s easy to make a case for the energy sector being the worst laggard sector of the bunch.

Since the February 19, 2020, pre-coronacrash top … the energy sector (XLE) is down 38%, the worst of all 11 U.S. stock sectors. (Financials are the next closest, down 20%.)

Year-to-date … XLE is down 44%, the worst of them all. (Financials are the next closest, down 19%.)

And since September 11, 2018 (two years ago) … shares of XLE have fallen 54%!

Meanwhile, the only other stock sector in negative territory is financials (XLF), down 13%.

And the booming technology sector (XLK) is up 53% over the same time!

OK, I think you get the point. And of course, these performance figures are backward-looking, so some would say the energy sector is an easy target to pick on.

Nonetheless, I use the energy sector as a poignant example of the type of trade you should want to avoid at all costs!

The SPDR Energy Sector ETF (XLE) is now a full 57% off its 2018 high. That’s the type of loser you’ll do well to avoid, as it takes quite a few big winners to recover from a loss of that size.

So, how exactly do you ensure that you avoid these big losers?

Avoid Big Losers — Take a Page From My Playbook

I recommend taking a page from my Momentum Principle playbook …

That is, use a “trend rule” before buying into any stock or ETF.

A trend rule is simply your way of establishing guidelines for yourself, in helping you determine what you are and aren’t willing to buy.

One simple trend rule might read like this:

If the price of the stock is above its 200-day moving average, then consider it “buy-qualified.” Otherwise, I’m not permitted to buy this stock.

I’ve written extensively about the value in using even the simplest of these trend rules, like this 200-day moving average rule, in my Green Zone Fortunes newsletter.

In short, buying stocks and ETFs that are already trending higher is a great way to position yourself in high-probability, low-risk plays.

My simple trend rules have helped me avoid making bullish recommendations on the energy sector for the past two years now … and saved my readers from double-digit losses (or worse!)

And seeing as the sector has been obliterated, avoiding this mega-loser is just as valuable as the winning trades I’ve found in other, uptrending “leader” sectors.

Speaking of which … keep your eyes on your inbox. Beginning in October, I’ll also write to you about the “leader of the month.”

If you have questions — or feedback about this new segment — reach out to my team and me at feedback@dev.moneyandmarkets.com. We’d love to hear from you!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets

P.S. You can learn more about my specific trend rules, and more generally the Momentum Principle I follow, by securing membership to my flagship newsletter, Green Zone Fortunes.