Dollar Tree has saved me on more than one occasion.

Especially when I want to spoil my five-year-old niece with little gifts.

I could let her spend hours roaming the aisles, picking out as many things as she wants, and not spend more than $20.

But then came inflation.

Nothing is $1 anymore, and the appeal of the Dollar Tree tanked — at least for me.

I thought this move was going to destroy the store.

But it didn’t. In fact, the opposite happened.

The company has had quite the success with the change, and it’s apparent in its Stock Power Ratings.

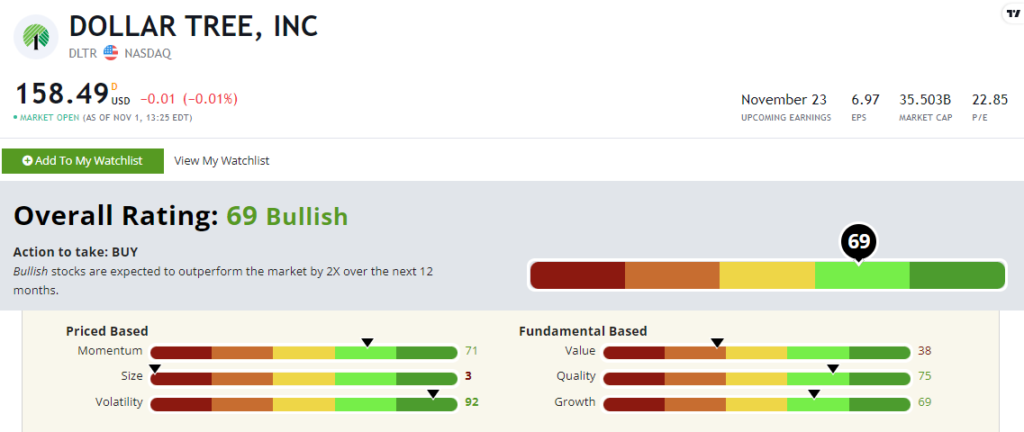

Dollar Tree Inc. (Nasdaq: DLTR) rates a “Bullish” 69 out of 100 on our proprietary Stock Power Ratings system.

Let’s take a closer look at the movement away from the “dollar” zone before we get into its breakdown.

Everything’s a Dollar? Not Anymore

At the beginning of the year, Dollar Tree made a big announcement.

After 35 years, the retailer would end its most prominent feature — its $1 price for everything in the store.

It wouldn’t change much, but most items on its shelves would now cost $1.25.

At first, consumers did not handle the news well. Many people took to social media to let their outrage be known. Others protested by refusing to shop at the store at all.

It seemed like this was the nail in the coffin for Dollar Tree.

But the company saw sales increase over the last year.

According to its first-quarter earnings report, Dollar Tree exceeded earnings expectations by $137.3 million.

That’s an 11.2% sales increase despite the bad press!

Why’s this?

Inflationary pressures have forced American consumers to watch how they spend, which could mean more trips to discount stores.

Let’s take a closer look at how DLTR scores on our Stock Power Ratings system.

DLTR’s Stock Power Ratings & High Momentum

Many warned that Dollar Tree’s price rise would be the most detrimental move in retail history.

But the company’s stock is set to outperform over the next year.

I’ll get into its momentum factor in a second, but first, let’s look at Dollar Tree’s overall score.

DLTR’s Stock Power Ratings in November 2022.

Dollar Tree has beaten the odds according to our ratings system, earning a “Bullish” score of 69.

It rates green on 4 out of the 6 factors in our Stock Power Ratings system.

With high volatility (92) and quality (75) scores, the stock has less risk than the company’s management knows how to turn a profit.

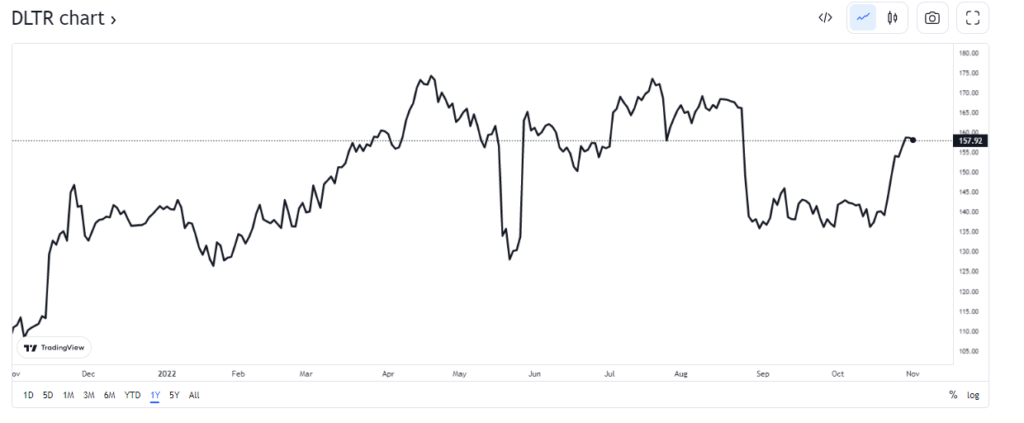

If we take a closer look at momentum, we can see how the sideways trading the stock witnessed in September and October.

Source: Tradingview.

After reaching it’s low of $135.68 on September 2, DLTR has seen solid upward trajectory.

Dollar Tree stock price climbed back around 15.7% since it’s September runoff.

This shows the upward trend we like to see and earns Dollar Tree a 71 on momentum.

The Bottom Line

Dollar Tree scores a “Bullish” 69 out of 100 on our Stock Power Ratings system.

Our system has much more in store for you!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!