Everyone needs health insurance, but some providers are in better shape than others. Is Cigna stock (NYSE: CI) a buy in 2023?

Our proprietary Stock Power Ratings system helps answer that question.

Cigna is a global health services company with operations spanning the United States, Europe, Asia Pacific, the Middle East and Africa.

It provides health insurance services, pharmacy benefit management services and other related products and services to individuals, families and employers.

In this article, we will take a closer look at Cigna’s business and its outlook for 2023.

Then, we’ll run Cigna stock through our Stock Power Ratings system to see how it stacks up in the current market.

What Is Cigna?

Cigna is an American health insurance provider that offers individual coverage plans as well as group policies to employers.

It also provides supplemental benefits such as vision care, dental coverage, prescription drug coverage, accident protection plans, life insurance policies, disability coverage plans and critical illness policies.

The company has more than 190 million customers in more than 30 countries and jurisdictions across the globe.

Let’s see how CI rates within our Stock Power Ratings system, a factor-based platform that tells you whether a stock is set to outperform or underperform the market from here.

Cigna Stock Power Ratings

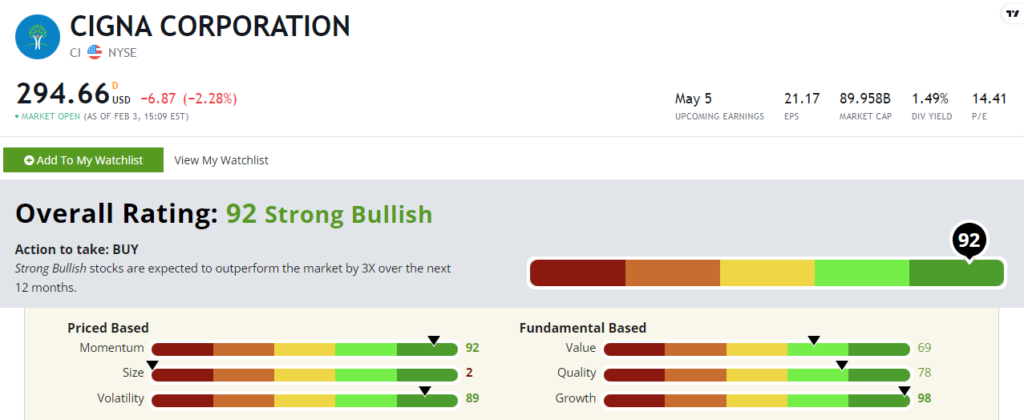

Cigna stock rates a “Strong Bullish” 92 out of 100. That means our system expects the stock to outperform the broader market by 3X over the next 12 months!

Cigna has enjoyed strong revenue growth for years, due in part to its acquisition of Express Scripts in 2018.

Total revenue boomed 216.5% in 2019 to a massive $153.7 billion. And it followed that with solid numbers throughout the COVID-19 pandemic:

- Total revenue grew another 4.4% in 2020.

- And it almost doubled that total in 2021 with a year-over-year growth rate of 8.5%!

That’s part of the reason why Cigna stock scores an impressive 98 out of 100 on our growth factor rating.

Looking at momentum, CI was on fire throughout 2022 — in the midst of a bear market. The S&P 500 has lost more than 8% over that same time frame.

It’s gained 32% in the last 12 months as I write. That’s what we call “maximum momentum,” here at Money & Markets. And it shows why Cigna stock scores a 92 on the momentum factor.

Bottom Line: Cigna has been performing well in recent years despite disruption caused by COVID-19 pandemic.

Furthermore, through strategic acquisitions, especially with Express Scripts, Cigna is positioning itself for more success ahead.

And our Stock Power Ratings system shows that Cigna stock is set to outperform the broader market by a good clip from here.

Note: If you are looking for more ways to invest in the next wave of health care, you need to check out our premium stock research service, Green Zone Fortunes.

Adam O’Dell is convinced the genomics (aka DNA science) revolution will be bigger than the interest. If you want to know why, click here to watch his “Imperium” presentation.

You’ll learn how you can start investing in Adam’s No. 1 stock in the genomics mega trend. (It’s up more than 20% in the last month!)