Inflation is making us do double takes at the grocery store because of high prices.

I, for one, am more selective when I shop.

But I don’t cut corners when it comes to personal care products such as razors and lotion. (We’re talking about my face here!)

The chart above shows U.S. beauty and personal care companies’ revenue.

Growth was steady until 2020, when COVID shutdowns halted product sales.

From 2020 to 2026, revenue will grow 28%.

Consider this for perspective: In 2020, we spent $234.77 per person on these products.

By 2026, it will hit $290.65.

Today’s Power Stock makes personal care and beauty products: BIC SA (OTC: BICEY).

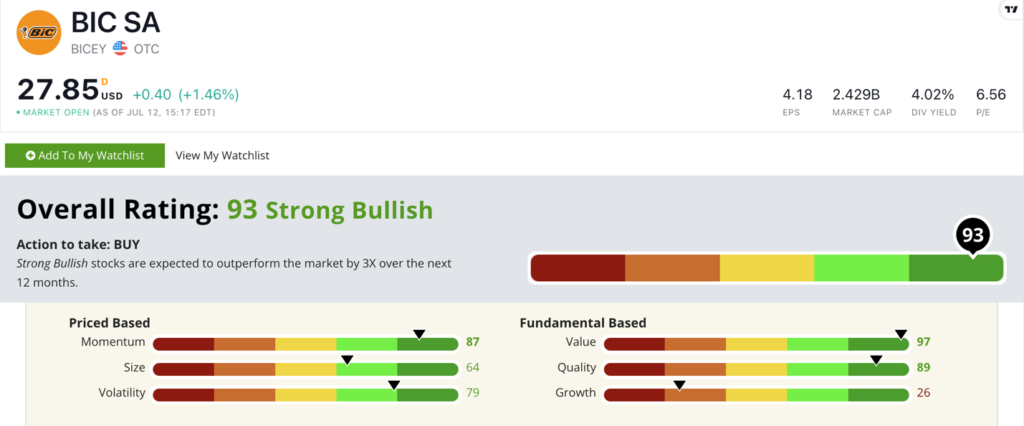

BIC Stock Power Ratings in July 2022.

I imagine you're familiar with Bic’s lighters and ballpoint pens.

The company also makes:

- Razors (disposable and refillable).

- Shaving cream.

- Lotions.

- Fingernail polish.

BICEY stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

BICEY Stock: Excellent Value + Solid Quality

Bic had an outstanding 2021.

Details include:

- Total annual revenue of $1.8 billion — a 12.5% increase over 2020!

- Operating margin rose from 9.6% in 2020 to 24.7% in 2021.

BICEY earns a 97 on our value metric due to strong price-to (earnings, cash flow and book value) ratios.

Its price-to-earnings ratio is a reasonable 6.6 — half the leisure goods products industry average.

The same goes for Bic’s low price-to-cash flow ratio of 4.9.

It all means BICEY is a better bargain than its peers.

BICEY stock hit its 52-week low in March. Since then, it’s gained 23.2%.

Over the last 12 months, BICEY is down 6.6%, but it’s still beating the leisure goods sector, which is down 43% over the same time.

Bic stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

In spite of inflation, many Americans (myself included) aren’t willing to give up our wellness and beauty products.

Bic stock is a smart addition to your portfolio.

Bonus: The company’s forward dividend yield of 4.2% means it will pay you $1.15 per share, per year just to own the stock.

Stay Tuned: Top Metals Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a solid industrial metals stock to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.