If you are looking for a steady income and want to invest in the next tech revolution, check out Money and Markets‘ six 5G dividend stocks to buy now.

It’s one thing to profit off the share price of a company.

It’s another to be able to do that and earn a steady stream of income on top of that.

That’s why investors looking for that “endless income” look at stocks that are not only growing but also paying a monthly, quarterly or yearly dividend.

To put it simply, a dividend is a payment made by a company to its shareholders. It is paid by the revenue the company earns. A dividend can go up or down, depending on its revenues in any given quarter.

Shareholders of 5G companies stand to gain even bigger because as the 5G revolution expands, share prices are sure to go up. As the revenue of those companies goes up, so will their dividends.

6 5G Dividend Stocks to Buy Now

1. Xilinx

The first company on our list is a San Jose, California-based semiconductor company that created the first fabless manufacturing model.

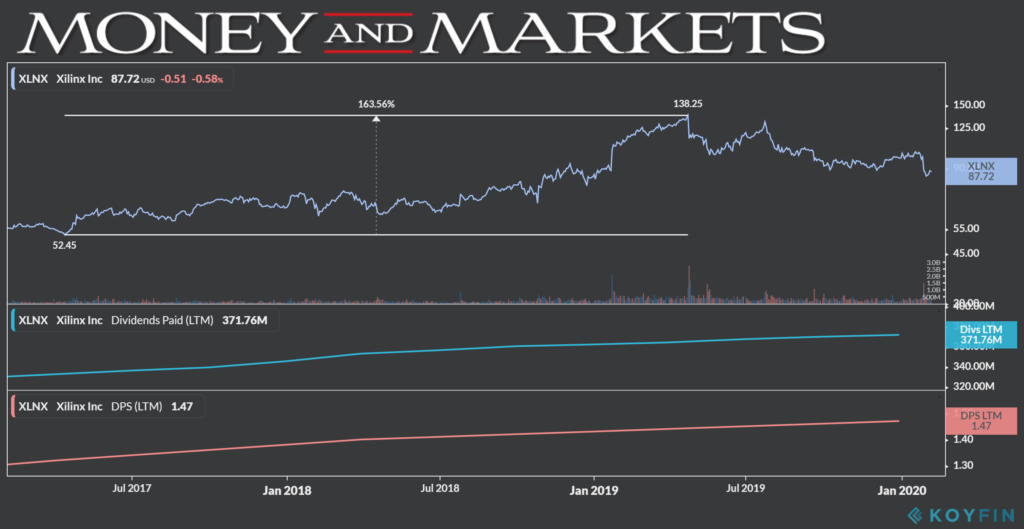

Xilinx Inc. (Nasdaq: XLNX) had a 163% jump in share price from April 2017 to April 2019, but started to fall off a bit following a mixed earnings report in its recent third quarter.

But that drop was only 37% from its high back in April.

Despite the small drop, Xilinx has increased its dividend payments since March 2018. It paid out more than $371 million in dividends in December 2019.

In addition, its dividend yield has grown from 1.4% in March 2018 to 1.47% per share in December 2019. That amounts to a dividend payment of $0.37 per share.

Because of its steady dividend growth, Xilinx is one of the six 5G dividend stocks to buy now.

2. Skyworks Solutions

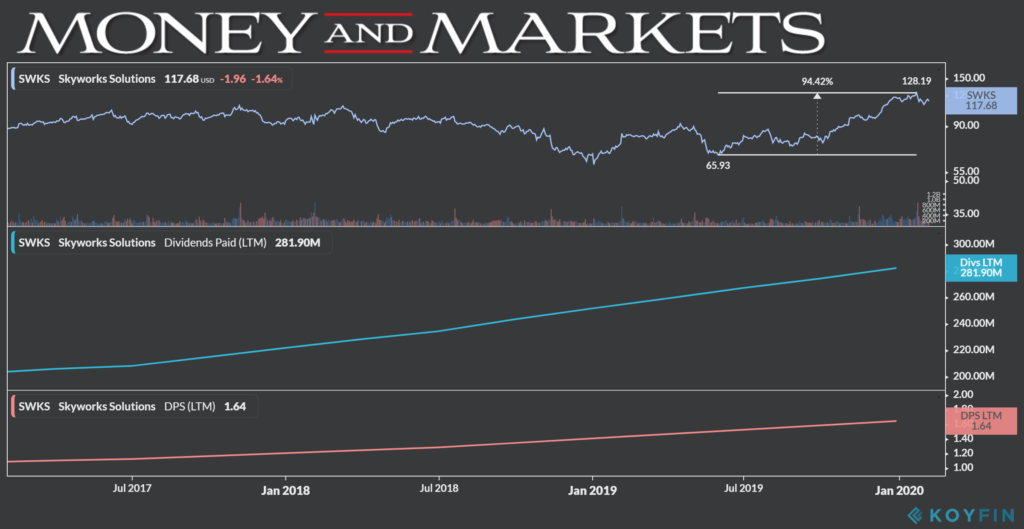

Skyworks Solutions (Nasdaq: SWKS) is a chip supplier that gets about half its revenue from a supply deal with Apple Inc. (Nasdaq: APPL) — that was part of the reason why we named it one of our four semiconductor stocks to buy now.

As Apple continues to position itself to roll out 5G-compatible equipment, Skyworks will grow exponentially.

Despite a price dip in June 2019, Skyworks has rebounded to gain more than 90% since then.

But even better, its dividend payments have been strong. In June 2017, Skyworks paid $207 million in dividends. During its last quarter in December 2019, that payment jumped to $282 million.

Its dividend yield also jumped to 1.64% from 1.12% during that same time. Skyworks’ next dividend in February 2020 will pay $0.44 per share.

Just like Xilinx, steady yield growth and the potential for even stronger dividends in 2020 make Skyworks Solutions of the six 5G dividend stocks to buy now.

3. Taiwan Semiconductors

The next company on the list is the largest semiconductor player in the market.

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) makes microchips for Qualcomm Inc. (Nasdaq: QCOM), Nvidia Corp. (Nasdaq: NVDA) and Apple. It has nearly 50% market share already.

Shares of the company have jumped 66% since May 2019 — joining Skyworks on our list of four semiconductor stocks to buy.

![]()

With its dividend, Taiwan Semiconductors has seen a 29% increase in total dividend payments from September 2019 to December 2019 to $8.5 billion.

Now its dividend yield is lower than most — at 0.48% from 0.26% in December 2018, but that dividend payment was $0.32 per share in December 2019.

As the 5G revolution continues to manifest, expect that dividend growth will only get bigger.

That’s why Taiwan Semiconductor is one of our six 5G dividend stocks to buy now.

4. AT&T

Long gone are the days of Ma Bell and her telephone company.

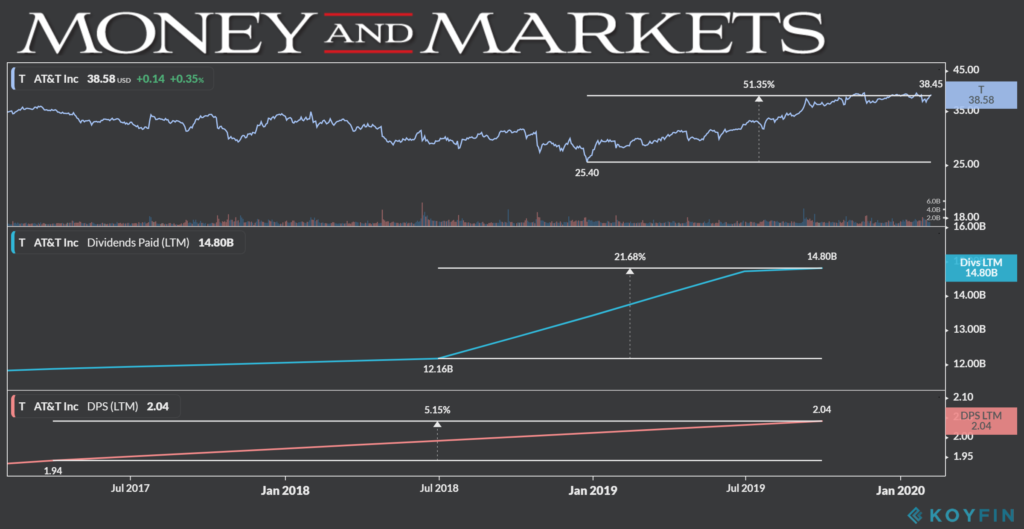

AT&T Inc. (NYSE: T) is growing into a global leader heading into the 5G revolution with diverse products and solid infrastructure. The company was one of our seven 5G stocks to buy now!

Since December 2018, the share price of AT&T has grown 51% and that growth only seems to be getting stronger.

In terms of dividend, AT&T has one of the highest dividend-per-share yields of any company — 2.04%. It’s seen a steady 5% climb in dividend yield since April 2017.

Its last dividend payment was $0.52 per share in January 2020, making it one of the biggest dividend payouts in the 5G space.

In total, the company paid out $14.8 billion in dividend payments in September 2019 — a 21% jump from the $12 billion it paid in June 2018.

The strength of one of the biggest dividend payouts in the sector makes AT&T one of the six 5G dividend stocks to buy now.

5. Cisco Systems

Another way investors can make a profit from the 5G revolution is by buying into companies that provide security for 5G networks.

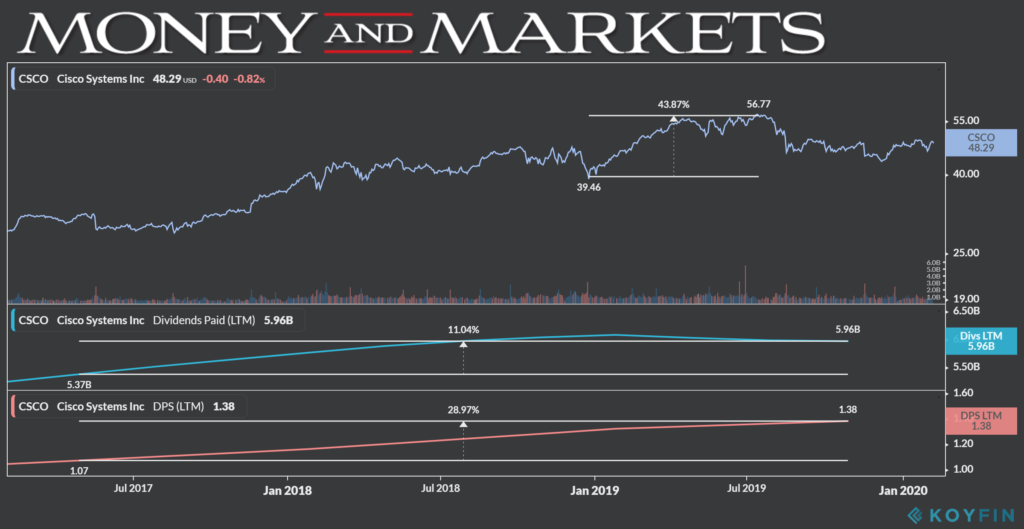

One of the largest in that area is Cisco Systems Inc. (Nasdaq: CSCO). The company provides hardware and software designed to protect connections and networks worldwide.

From late-2018 to June 2019, Cisco shares jumped 43%. Like other tech stocks, they suffered pushback into 2019, but have started to climb back.

The company paid out $5.9 billion in dividends in October 2019 — an 11% jump from the $5.3 billion it paid out in April 2017.

Its dividend yield has also grown steadily over time. From April 2017 to October 2019, the dividend yield for Cisco jumped 28.9%. Cisco’s latest dividend payment was $0.35 per share in January 2020.

That strong yield and the position Cisco is in with the 5G revolution make it one of our six 5G dividend stocks to buy now.

6. iShares MSCI EAFE Growth ETF

Let’s not forget that the 5G revolution is global, not just confined to the U.S.

Let’s not forget that the 5G revolution is global, not just confined to the U.S.

As investors look for ways to diversify their portfolio, one way is through an exchange-traded fund — known more commonly as ETFs.

If you are looking for investment outside the U.S. but still want to capitalize on the 5G revolution, you can look at the iShares MSCI EAFE Growth ETF (NYSE: EFG).

It holds tech companies like SAP AG (NYSE: SAP) and British telecom giant Vodafone among its many holdings. But it also holds health care companies and European banks as well.

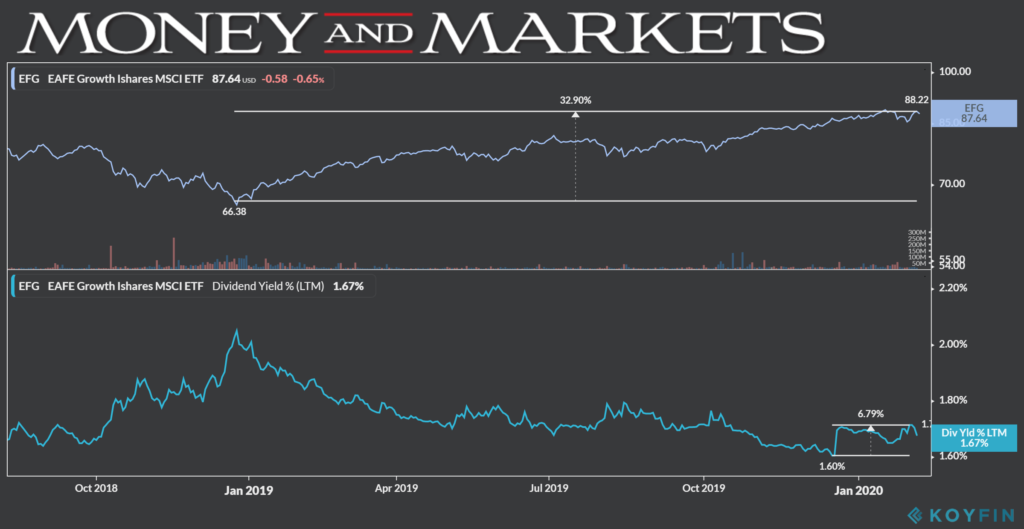

Since bottoming out at $66 a share in December 2018, shares of the ETF have grown nearly 33% to its 52-week high in January 2020.

In terms of its dividend yield, the ETF did drop off in January 2019 but has started to rebound in 2020. The yield has moved up 6.7% since December 2019 to 1.67%. Its most recent dividend payment was $0.49 per share in December 2019 — one of the highest dividend-paying stocks on our list.

Because of that high dividend payment and the fact that the ETF is in a growth pattern makes iShares MSCI EAFE Growth ETF one of our six 5G dividend stocks to buy now.

There you have it; everything from legacy companies to ETFs, there are a lot of ways to profit off the coming 5G revolution.

But there are different ways to profit from what’s on the way. Dividend stocks provide not only stock price growth but consistent income over time.

These companies have the ability to provide that steady flow of money in addition to the potential to grow because of the 5G revolution.

That’s why they are on our list of the six 5G dividend stocks to buy now.

Related

- 4 Cloud Software Stocks to Buy Now

- 4 Semiconductor Stocks to Buy Now

- Top 5 ETFs to Buy in 2020

- 4 Stocks to Buy and Hold for 2020

- 5 Tech Stocks to Buy in 2020

Looking for stocks to buy not on our list? Let us know by emailing feedback@dev.moneyandmarkets.com or leave a comment below!